The US monetary authorities are concealing the monetary bubble that has been developing since the early 2000s.

According to official figures, it is actually worth around $24 trillion!

It is gigantic, lethal, and could burst at any moment.

To conceal it, the federal government is borrowing $7.6 trillion, which is stagnating in Treasury bills in the coffers of intra-governmental agencies, and $900 billion in government coffers, to which must be added $5.8 trillion in Fed assets, which removes more than $14 trillion from the money supply… To this must be added $9.2 trillion in excess M3 money supply, for which overall figures are no longer published.

All this data is published by federal agencies…

The federal government’s gross debt, published at $38.647 trillion, or 124% of GDP, is not a major problem but a decoy, as the actual net debt is only $23 trillion, or 78% of GDP.

***

To understand these monetarist issues, we need to briefly return to the fundamentals and the previous century…

The 20th century was characterized by the opposition of communism to liberal capitalism from the beginning of the century with the Russian Revolution of 1905 until the end with the collapse of the USSR in the 1990s.

Fortunately, in 1944, US leaders had the good sense to understand that the necessary condition for winning the free world’s fight against communism was to establish a sound and reliable international currency that could serve as foreign exchange reserves and a means of international payment, namely, of course, the US dollar.

The problem then was: what is a sound and reliable international currency?

The answer was provided, among others, by Paul Volcker in his 1949 thesis, “The Problems of Federal Reserve Policy since World War II”: “a swollen money supply presented a grave inflationary threat to the economy. There was a need to bring this money supply under control if the disastrous effects of a sharp price rise were to be avoided.”

In other words, there should be no monetary bubble (or hypertrophy) in the United States, which means that the amount of money in circulation should not exceed certain limits… to be defined.

The problem then was to define these limits.

The solution was provided clearly and empirically, but not explicitly or theoretically…

Since a nation’s currency is matched by the total amount of goods and services produced, or in other words, since every product has a price in that currency, the amount of money in circulation is expressed as a percentage of current annual GDP.

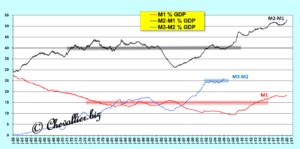

Based on monetary aggregate data published by the Fed from the post-war period until February 2006, it appears that the M1 monetary aggregate should not exceed the critical threshold of 15%, this ratio is 40% for the M2-M1 aggregate and 25% for M3-M2.

Document 1:

A nation’s total M3 money supply should therefore not exceed 80% of current GDP, which was respected during the last quarter of the 20th century, but since 2000, this ratio has fluctuated on a clearly upward long-term trend, well outside the norm since 2007,

Document 2:

Paul Volcker and then Alan Greenspan therefore succeeded in keeping the money supply within its optimal range before 2000, i.e., during the period dominated by the Cold War, which was essential at the time to counter the threat of communism.

The same was true in West Germany with Karl Otto Pöhl, who did not want to continue as president of the Bundesbank after the political authorities imposed the Deutsche Mark as the sole currency during the reunification of the two Germanys, which had disastrous consequences.

With the danger of communism gone, the political and monetary authorities relaxed their control over the financial sector in the early 2000s.

This led to the emergence and development of new financial products such as derivatives, bitcoin, cryptocurrencies, CDS (Credit Default Swaps) and others, which significantly increased the money supply, which then far exceeded the norms.

The American political and financial microcosm, taking advantage of this windfall but aware of the seriousness of its excesses, appointed Ben Bernanke as chairman of the Fed at the end of 2005 to manage the looming crisis.

The first decision he made, even before taking office, was to discontinue the weekly publication of M3 money supply figures from February 2006 onwards, so that only Fed insiders would have access to them, as these were the basic data that would have enabled monetarist economists to correctly analyze the development of what was to become the Great Recession.

This American political and financial microcosm continued to reap considerable undue profits from these financial products, without any limits, even during the Great Recession, and this situation continues today.

Ben Bernanke and his successors have therefore not sought to put an end to this increase in monetary hypertrophy because it continues to benefit those who put them in charge of the authorities whose function is to put an end to it in order to restore sound money.

They have found a solution to ensure that the US financial system continues to enrich this American political and financial microcosm… without collapsing.

This solution consists of sucking up trillions of dollars in excess liquidity and placing it in Treasury bonds held by the Fed and government agencies, which has the advantage of containing the money supply in circulation!

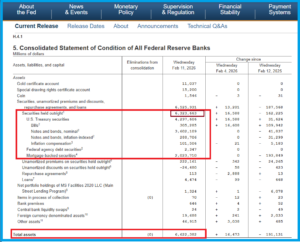

As a result, the Fed’s assets include $6,323.663 billion in government securities (Treasury bills and mortgage-backed securities) … which normally have no place there, for a total of $6,622 billion in assets!

Document 3:

These more than $6 trillion should never have been included in the Fed’s assets!

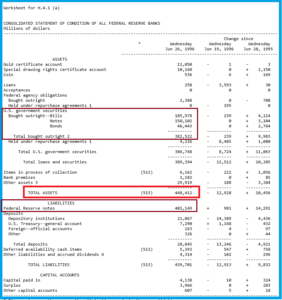

In fact, the oldest weekly Fed balance sheet still published on its website, dating from June 1996, shows only $382.5 billion in Treasury bills for total assets of $448.4 billion, which can be considered normal because Fed officials can and must be able to conduct the open market policy, they deem necessary to regulate economic activity.

Document 4:

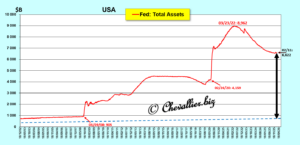

The Fed’s total assets, which were less than $500 billion in 1996, should have continued to fluctuate at a level below $1 trillion today, but instead they jumped to… $9 trillion in March 2022 to remain at around $6.6 trillion in 2026, according to data from our friend Fred in St. Louis,

Document 5:

To simplify and give an order of magnitude, the Fed’s total assets should fluctuate around $800 billion.

This means that $5.8 trillion (6.6 trillion – 800 billion) is currently abnormally invested in the Fed’s assets in government securities.

These $5.8 trillion are thus withdrawn from the money supply in circulation in the United States… which has the advantage of giving the illusion that the monetary bubble that has developed there is not a major problem.

In other words, these $5.8 trillion would need to be added to the total US money supply M3 (which amounts to $34.5 trillion) to give an accurate picture of reality, i.e., a money supply of… $40.3 trillion, which would propel the M3/GDP ratio to stratospheric levels!

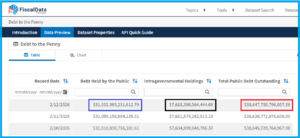

Furthermore, the federal government’s officially published debt amounts to $38,647 billion, but $7,615 billion is abnormally held in the treasuries of intra-governmental entities and also invested largely in government securities.

Document 6:

These $7.615 trillion are therefore, as mentioned above, withdrawn from the money supply in circulation in the United States… which has the advantage of giving the illusion that the monetary bubble that has developed in the United States is not a major problem.

And so, once again, we would need to add to the total M3 money supply, which amounts to $40.3 trillion, taking into account the securities held by the Fed (see above), these $7.615 trillion to give a true picture of reality, which would push the US money supply to around $47.9 trillion and the M3/GDP ratio to stratospheric levels!

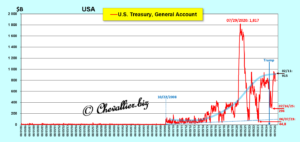

Finally, the Treasury’s cash reserves are also abnormally high. In fact, they amount to more than $900 billion, whereas before 2008 they were generally in the range of $5 to $10 billion!

Document 7:

Successive Treasury Secretaries are not mismanaging their cash reserves; they are clearly acting deliberately in concert with the Fed and government agencies to absorb an additional $900 billion from the money bubble, peaking at over $1.8 trillion in 2020, which is completely inconsistent with their mission!

Finally, adding these $900 billion to the total M3 money supply defined above, i.e., $47,900 billion, the U.S. M3 money supply should actually amount to around $48,800 billion, or 157% of the current GDP of $31,098 billion!

In total, therefore, $14.3 trillion (5,800+7,600+900) has been removed from the total US M3 money supply figures through these purchases of government securities by the authorities, which is not in line with their functions.

In reality, these are reprehensible manipulations designed to deceive everyone, first and foremost American taxpayers, because these trillions of dollars are borrowed on the markets, which increases the debt burden and therefore their taxes.

These manipulations are all the more shocking because they are intended to conceal the undue profits made by the political and financial microcosm…

***

Additional information…

This hypertrophy of the US M3 money supply does not come from the famous “money printing press.”

In fact, it is not a case of money creation ex nihilo, but of money that has been abnormally but effectively earned, borrowed by the Treasury but abnormally or even fraudulently retained.

Since a debt to oneself cancels itself out, the major problem for the United States is not the size of the debt (of the federal government) but the total money supply actually in circulation, which is accurately recorded in the published figures for the reconstructed M3 money supply and which is concealed in the manipulations of Treasury bills.

Furthermore, the federal government’s real debt is not $38.647 trillion, as indicated in the official figures, which refer to its abnormally inflated gross amount, but its net debt, i.e., this amount minus the amount of bonds abnormally held by government entities, or $14.3 trillion.

The actual net debt of the federal government is therefore approximately $24.3 trillion ($38,647.7 billion – $14.3 trillion), which corresponds to 78% of the current GDP of $31.098 trillion, which is considered normal.

What is not normal is the amount of gross debt, which is fraudulently inflated at the expense of American taxpayers (especially with high interest rates) for the greater profit of the political and financial microcosm.

The United States is therefore on the brink of collapse, not because of federal government debt, but because of the hypertrophy of the money supply resulting from financial products that have no connection with reality, i.e., with the creation of goods and services to ultimately meet consumer needs.

These financial products were created by the political-financial microcosm for its own profit, to the detriment of 340 million Americans.

Paul Volcker tried to oppose these abuses, but his opponents were more powerful and influential.

It is surprising to note that he was not even followed by the free financial community, which often analyzes the evolution of these financial excesses with a certain critical eye… because it refuses to take into account the major role played by variations in monetary aggregates, which is nevertheless the basis of economic activity and monetarism.

The lack of monetarist culture has been fatal to America!

Furthermore, it is possible that this monetary bubble was created deliberately by the people with the most influence in the political and financial sphere, namely the revisionist Zionists, as shown by the fact that Donald Trump chose Kevin Warsh as the next chairman of the Fed.

Indeed, he has the distinction of being the son-in-law of the president of the World Jewish Congress…

***

It is possible that China’s leaders are aware of these financial and monetary problems in the United States, which is thus potentially on the brink of collapse.

This may be why President Xi Jinping has just reiterated that the renminbi should be able to become a global reference currency, replacing the US dollar, which will have been destroyed by its own political and financial microcosm that controls it…

As China becomes the world’s leading producer of goods and services, and as the counterpart to a nation’s money supply is the mass of goods and services produced there, it is logical that its currency, the renminbi, will naturally become the main currency used in the world in the future.

It is surprising to note that China’s leaders, who have managed the development of the productive system well, have made major mistakes in the financial and monetary fields.

Indeed, the Chinese currency is handicapped by its scarcity of use around the world. Clearing houses should have been developed to facilitate international transactions using the renminbi, as the Americans did after Bretton Woods.

***

Click here to read a Bloomberg article about Xi Jinping’s statements.

Click here to read a well-researched article on the problems with the yuan and the dollar.

Click here to access the U.S. government website publishing debt figures.

Click here to read one of my articles on US debt.

© Chevallier.biz