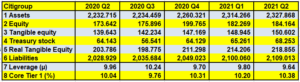

Citigroup’s leverage dropped to 9.64 in 2nd quarter 2021 after the turbulence caused by this coronavirus, which is perfect!

Document 1:

Amounts in billions of dollars.

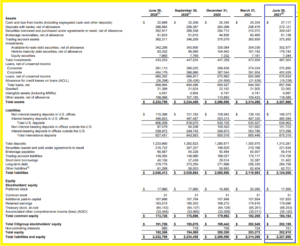

Provisions to cover Non-Performing Loans (NPLs) amount to $19.238 billion down from 3Q2020 when they peaked at $26.4 billion on 676.834 billion in loans originated (down from $721 billion in 1Q2020).

Document 2:

So, a decrease in provisions for default risks on loans granted and a decrease in the total of these loans, which is doubly positive because it shows that the managers of this bank are managing it with prudence and that the expected losses are lower than what was feared.

Citigroup has started to buy back shares again, for an additional $3 billion in the second quarter, which logically appears as a deduction from shareholders’ equity under Treasury stock for a total of $68.253 billion.

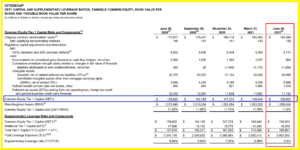

In order to give a true picture of the reality of the real tangible equity, it is therefore necessary to reintegrate these Treasury stocks into the tangible equity, which makes it possible to obtain the true leverage of this bank

The leverage is calculated from the data published by the bank for the tangible equity with the deduction of the preference shares, goodwill and intangibles.

Like other banks, Citigroup publishes its tangible equity figures,

Document 3:

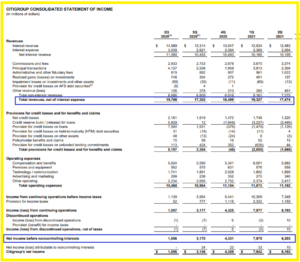

This bank’s net profitability is t high: 35.5% with $6.203 billion in profits on revenues of $17.474 billion,

Document 4:

Citigroup’s stock price has fallen from a high reached on June 3,

Document 5:

Citigroup’s share price is therefore still highly and abnormally undervalued, especially since its market capitalization of $150 billion is equal to the amount of its tangible equity, which is considered to be the scrap value of a bank.

Indeed, the Price / Earnings ratio (the PER) is only 7.5!

The irrationality of the markets is still present…

tor/qer.htm”>Click here to read the latest Citigroup financial report.

Click here to read my article in French about this bank.

The image at the beginning of the article is the one of Citigroup’s first establishment on Wall Street in 1812.

© Chevallier.biz