tok.png”>tok-300×198.png” alt=”” width=”300″ height=”198″ />

The banksters of Groupe BPCE do not publish in their quarterly financial reports the data to know precisely the real amount of their equity.

According to the figures published for the year 2020 and the accounting rules in force, the tangible equity of Groupe BPCE is… negative: around… – 50 billion euros!

BPCE should therefore have been declared bankrupt!

The net situation of this banking group is worse in reality because the notional commitments on derivatives are… 6,000 billion euros!

Like their European counterparts, the banksters of BPCE are not accounting for the losses on the loans they have granted to their clients who will never pay them back because of this coronavirus story.

***

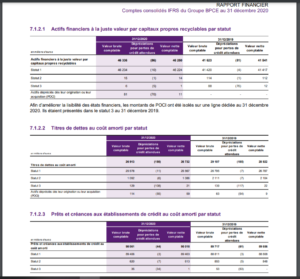

BPCE Group’s 2020 financial report classifies loan amounts into the three categories (Stages) of risk based on IFRS 9 rules and provisions for fiscal 2019 and 2020,

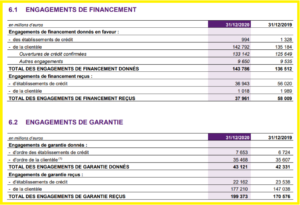

Document 1 (only in French):

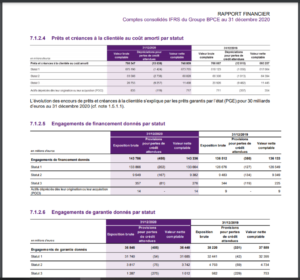

Document 2:

The amounts of projected losses not provisioned (line 8, Spread…) are the difference between on the one hand the loans at risk (categories 2 and 3) to which must be added 1% of the amount of the so-called… non-risk loans, which constitutes the NPLs (Non-Performing Loans) and on the other hand the provisions (line 7), for fiscal years 2019 and 2020,

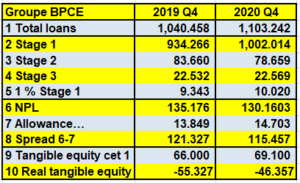

Document 3:

Amounts in billions of euros.

So, according to these figures 115.457 billion euros are not provisioned out of the 1,103.242 billion euros of loans granted by the banksters of BPCE to their clients at the end of 2020!

As the published amount of tangible equity is 69.1 billion euros (line 9), it is therefore losses of 46.357 billion (line 10) that are not provisioned and which are therefore negative equity…!

Indeed, we have 69.100 – 115.457 = – 46.357

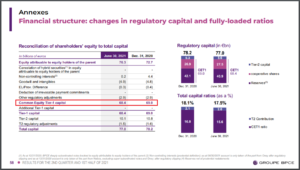

Document 4:

46.357 billion euros of equity… negative for the end of 2020 but the situation has deteriorated in 2021: tangible equity has decreased and total loans have increased!

Therefore, the (negative) equity is about -50 billion euros, an intermediate figure between those of 2019 and 2020.

The banksters of BPCE still have the precaution of taking sufficient collateral overall for their off-balance sheet commitments,

Document 5 (only in French):

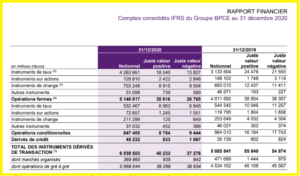

Moreover, the BPCE banksters publish notional commitments on derivatives for a total of… 6,000 billion euros at the end of 2020!

Document 6:

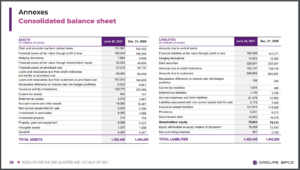

Balance sheet of the BPCE group in the 2nd quarter of 2021,

Document 7:

BPCE is not listed on the stock exchange.

***

The three largest French banks (Société Générale, BNP-Paribas and BPCE) should have been declared bankrupt under current IFRS accounting rules because their tangible equity is largely negative!

A banking tsunami can happen at any time in Europe.

Click here to read the BPCE financial report from which this information is taken.

Click here to read my article in French on the BPCE financial report.

© Chevallier.biz