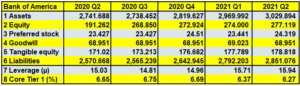

Bank of America has too much debt relative to equity. Its leverage was too high and it increased again compared to previous quarters,

Document 1:

Amounts in billions of dollars.

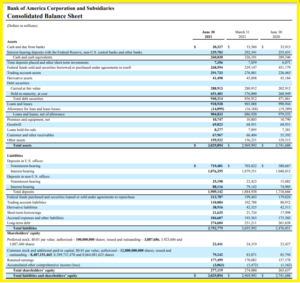

The amount of loans increased by $16 billion from the previous quarter to $919 billion and the provisions decreased by $2 billion which means that the crisis caused by the coronavirus is over.

So this bank is operating normally now.

Bank of America’s balance sheet total exceeds $3 trillion for the first time!

Document 2:

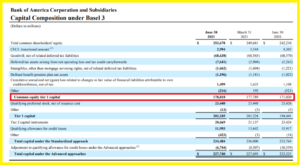

Bank of America has still not been able to overcome the consequences of the mistakes its managers made in the early 2000s because the bank still has $69 billion in goodwill and it still cannot buy back shares like the other big US banks.

The published amount of real tangible equity is therefore low because of goodwill and preferred stock,

Document 3:

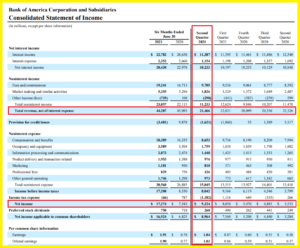

Bank of America’s profits of $9.224 billion have been steadily increasing since the beginning of the coronavirus crisis,

Document 4:

With revenues of 21.466 billion dollars, the net profitability of Bank of America is… 43.0% which is higher than that of the other big US banks!

Bank of America’s bank capitalization is $355 billion and its Price / Earnings ratio (PER) is 13.9.

Bank of America’s share price reached a high on June 3 (since its great plunge in 2008-2009). It fell during June and July but is back near that June 3 high,

Document 5:

tor.bankofamerica.com/phoenix.zhtml?c=71595&p=quarterlyearnings#fbid=yZUVwK6KuEN”>Click here to read Bank of America’s latest financial report.

Click here to read my article in French about this bank.

© Chevallier.biz