This is a major issue that nobody is commenting on!

This is a major issue that nobody is commenting on!

It is however the first time since World War II that the Fed decided to change the definition of a monetary aggregate, M1, and to no longer publish the weekly data of the monetary aggregates M1 and M2…

The Fed has only made one such decision since the war: that of stopping the publication of the figures of the total money supply of the United States, M3, decided by Ben Bernanke… before he effectively and officially took over the chairmanship of the Fed with immediate effect when he took office in February 2006!

The reason was simple: he did not want monetarist economists to have access to these fundamental data that would have allowed them to correctly analyze the evolution of monetary aggregates and thus to anticipate the Great Recession of 2008-2009.

What is the Fed up to now?

It is difficult to know and therefore to anticipate correctly and precisely what will happen in the near future because of the absence of the publication of these weekly fundamental data, which are those of the M1 and M2 aggregates, which are also modified in their composition.

The subject is all the more important as a hypertrophy of the money supply has developed in the United States with this coronavirus story… but without undue money creation as it is financed by borrowing!

What is certain is that a recession will occur in the United States in the near future and that it will have major repercussions elsewhere in the world, and in particular in Europe, which is already weakened by the crisis caused by its political leaders who have taken the worst decisions under the pretext of this coronavirus story.

Instead of having a return to strong growth, old Europe will sink into crisis and depression with a colossal and lethal hypertrophy of the money supply due to undue monetary creation…

To have some ideas on the consequences of such a monetary bubble, (re)read Pierre Jovanovic’s book : Adolf Hitler ou la revanche de la planche à billets (only in French!).

In my Gold offers, I provide articles allowing to correctly analyze these problems, which allows to anticipate the evolution of the markets, in particular the financial ones, and in my Platinum offers, I provide all the information to save and even to increase the value of one’s financial assets in anticipation of the next financial turbulences…

***

The Fed announced on December 17, 2020 that it would change the definition of the M1 monetary aggregate effective May 2020 by moving Savings deposits from the M2-M1 aggregate into the M1 aggregate,

Document 1:

These savings deposits are deposits on money market deposit accounts, which have always been included in the M2-M1 aggregate bec ause this aggregate corresponds to households’ deposits on interest-bearing savings accounts, which is perfectly logical.

ause this aggregate corresponds to households’ deposits on interest-bearing savings accounts, which is perfectly logical.

Document 2:

As a reminder, a nation’s money supply is made up of three aggregates: M1 corresponds to the means of payment available to households (which includes banknotes and current account balances), M2-M1 is the savings of these households (i.e., the money they invest to use later for investment), and M3-M2 corresponds to the total cash holdings of businesses (including banks).

These distinctions are important, because changes in M1 and M2-M1 provide insight into changes in household behavior: if they are confident about the future, they spend more and M2-M1 decreases, and vice versa…

These weekly data have always been published by the Fed (for decades, often since the post-war period) and can be downloaded by our friend Fred from Saint Louis.

However, the Fed has just decided that these Savings deposits will be integrated into the M1 aggregate, which is totally contrary to any elementary logic.

Any monetarist analysis conducted for decades is now impossible because of the discontinuous series.

Worse: the Fed has decided to stop publishing these weekly data, which eliminates any fine analysis of their variations!

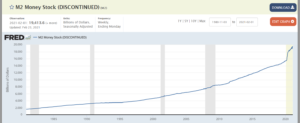

Document 3:

M1 and M2 data will only be published monthly.

As a result, the published data for the M1 aggregate jumps in an insignificant way since May 2020…

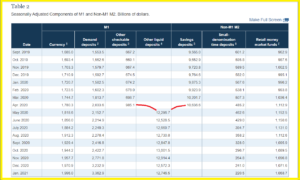

Document 4:

…and conversely those for M2-M1 plunge since that date…

Document 5:

… because M2 totals, i.e., the total money available to U.S. households in aggregate, do not change in definition,

Document 6:

Why did the Fed make these decisions?

The reasons published by the Fed are not credible.

Indeed, the information published is difficult to understand and very questionable since the result is to put savings accounts in the M1 aggregate when savings should be recorded in the M2-M1 aggregate!

The Fed has only changed the publication of monetary aggregates once before. So this is a rare and very important decision.

In reality, the members of the FOMC are like Ben Bernanke: they anticipate a new Great Recession and they want to be the only ones to have the finest monetary aggregates figures so that monetarist economists cannot know these data that would allow them to correctly analyze the evolution of the behavior of Americans, and therefore of the financial markets, in order to reliably predict this new Great Recession.

However, there are other indicators that allow us to anticipate the evolution of the markets, in particular the 10y-2y spread, i.e. the difference between the yields of 10-year notes and those of 2-year notes.

When this spread rises, a recession always occurs!

Document 7:

And this 10y-2y spread goes up because 10-year Note yields are rising rapidly while 2-year Note yields remain at a very low level because they are pegged to the Fed’s base rate which remains at the floor.

A new Great Recession will therefore inevitably occur in the near future in the United States and it will have dramatic consequences in Europe, which has already been heavily impacted by this coronavirus story…

***

People who have capital must therefore take steps to save it, or even to increase its value when this Great Recession occurs, and the deadline is approaching.

I provide in the framework of my Platinum offers the analyses of securities that have risen by 20% on average in the 4th quarter of 2020 and it can still be so at this moment, which constitutes a particularly interesting return!

I also provide analyses that will allow you to anticipate this Great Recession and solutions to increase the value of your financial assets when the equity markets plunge…

Online on my website in French on March 14, 2021.

© Chevallier.biz