The members of the FOMC have decided to stop publishing weekly data on the M1 and M2-M1 monetary aggregates, as they have been doing for… forever, that is, for several decades, in anticipation of the next Great Recession.

These data were very important because they allowed us to understand the behavior of Americans and therefore to know the evolution of the economy.

What about the latest data as of February 1, 2021?

By irony, the variations of the M1 and M2-M1 figures from one week to the other were (almost) null on February 1st compared to the previous week!

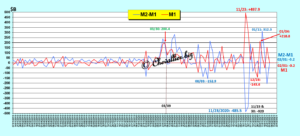

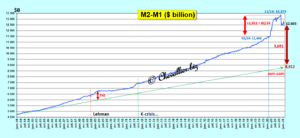

Document 1:

Yet these changes in M1 were of considerable magnitude for M1, which was up nearly… $500 billion as of November 23, 2020 from the previous week, meaning Americans were getting ready to spend it on Thanksgiving,

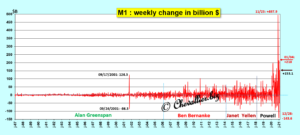

Document 2:

To fund this spending, they withdrew almost… $500 billion as of November 23, 2020 compared to the previous week,

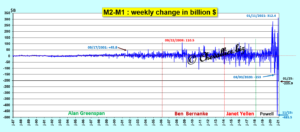

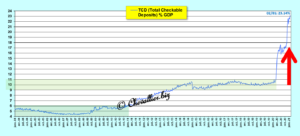

Document 3:

These data clearly confirm that Americans, that is, U.S. households had money available and were confident about the future.

Their availability has varied greatly since this coronavirus story began in mid-March 2020,

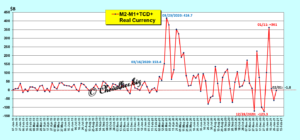

Document 4:

Their savings, i.e., their deposits in their savings accounts, amounted to $12 trillion overall, which is, to give an order of magnitude, $42,000 for each of the 300 million Americans, or $84,000 per couple (household),

Document 5:

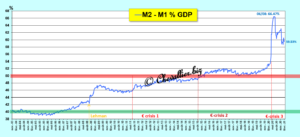

This savings corresponded to nearly 60% of current annual GDP when this ratio should have remained in the 40% range!

Document 6:

The gigantic support plan for the Americans wanted by the Donald to help them better bear the consequences of this coronavirus story has thus created a gigantic hypertrophy of the money supply… without undue monetary creation because all this money distributed was previously borrowed on the international financial markets.

The Americans have plenty of money!

They have money not only in their savings accounts but also in their current accounts: nearly $5 trillion, or more than $16,000 per person, $32,000 per household!

Document 7:

Overall, the amount outstanding in Americans’ current accounts has jumped from 10% of current annual GDP to over 20% of that ratio thanks to or because of this coronavirus story,

Document 8:

In total, Americans had more than $18 trillion available overall, which is the M2 aggregate, or more than $61,000 per person, $122,000 per household considering the bills in their wallets!

Document 9:

This money supply held by Americans represents 87% of current annual GDP when this ratio should not have exceeded 66%!

Document 10:

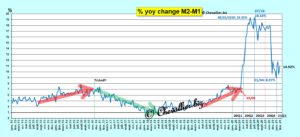

The year-to-year variations of the weekly M1 and M2 data that were published by the Fed for decades allowed to anticipate the variation of the real GDP, see my articles on the free money supply.

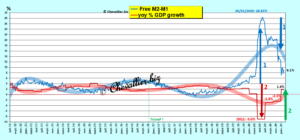

The latest data published for February 1 showed that M2-M1 increased by 10.9% year-on-year…

Document 11:

…which meant that real GDP growth was about +1.8% in this 1Q2021,

Document 12:

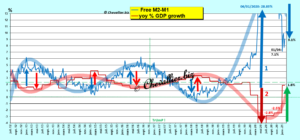

Zooming in by changing scale over the same period,

Document 13:

So, America exceeds the wealth creation level of the 1° quarter 2020, before this coronavirus story.

The data of the monetary aggregates as they were previously published were therefore very useful: they allowed to know the variations of the behavior of the Americans, which is very important because the growth of the GDP depends on their behavior, which confirms the importance of behaviorism…

Powell and his collaborators have become deaf and dumb in front of this Great Recession that is coming.

***

Online on my website in French on March 14, 2021.

Click here to read it.

© Chevallier.biz