***

Undue money creation has developed in the US since at least 2011 and this money naturally and logically ends up in deposits on the accounts of the banks’ customers, i.e. on their liabilities, thus opportunistically financing their assets, see my articles on this subject.

However, the US monetary authorities finally intervened (much too) late to reduce this money bubble which peaked during the last few years (from 2020 to 2022) and which has been on a downward trend since 2022, which is reflected in the data of monetary aggregates and in the data of deposits (Deposits) of the customers of the US banks, as I wrote earlier.

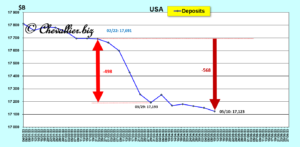

This decline in bank customer deposits is still continuing and has just passed the symbolic threshold of… $1 trillion as of May 3, and 1,035 billion as of May 10, the latest figures published by our friend Fred of St. Louis, from a high reached on April 13, 2022!

Document 1:

The drop in these deposits from April 13, 2022 to May 10, i.e., in just over a year, is $1.035 trillion, which is significant (for banks) but marginal compared to the overall money supply M3, a figure that Fed officials have refused to make public since 2006…

However, in the absence of figures for the overall M3 money supply, the evolution of US banks’ deposits provides a good indication of the amount of money in circulation in the US,

Document 2:

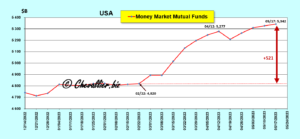

Zooming in on the recent period that clearly highlights that the Silicon Valley Bank failure was instrumental in prompting big money and corporate cash managers to move their uninsured capital out of commercial banks and into money market funds,

Document 3:

This decline in U.S. bank customer deposits suddenly increased at the end of February: $568 billion (very precisely) of these deposits (according to figures published by our friend Fred de Saint Louis) left the accounts of these banks to take refuge in money market funds, the total of which inversely increased by $521 billion,

Document 4:

Indeed, money market fund deposits increased by $521 billion during the same period according to weekly data (also indisputable) published by the Investment Company Institute (ICI) as of May 17, the latest figures published!

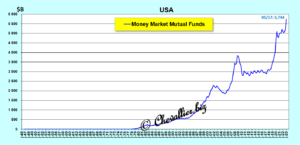

The ICI publishes weekly figures for deposits in money market funds but not their quarterly figures over the long term. Again, our friend Fred from St. Louis publishes them, but with some delay.

If we add the number of money market fund deposits published at the end of the first quarter of 2023 to the 521 billion recorded by ICI in April and early May, it becomes clear that the total of these deposits has suddenly exploded up to $5,744 billion, as it did before every major crisis!

Document 5:

The explanation of these capital movements is simple…

As a first reminder, the managers of corporate treasuries, in particular of Californian start-ups, knew that some of their banks were on the verge of bankruptcy.

They then hurriedly withdrew this money (568 billion dollars in March-April-May) which was on deposit in their banks to place it in money market funds which are not banks but financial institutions authorized to receive funds and invest them in short term securities, mainly US Treasury bills, which are considered (rightly) as undoubtedly safe investments.

Thus, the managers of these companies are certain to be able to recover their cash flow, which is irremediably safe from the failure of their usual banks.

The capital deposited in these money market funds has increased considerably precisely since the Great Recession of 2008-2009 and especially since 2020 because many cash managers and large private fortunes have lost confidence (and they are right!) in the American banking system.

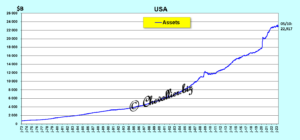

Deposits in US banks have therefore fallen by $568 billion (from a high reached on April 13), which has logically led to a fall in the total assets held by these banks to a total of… $320 billion as of May 10, the latest figures published by our friend Fred from Saint Louis,

Document 6:

Focus on the recent period,

Document 7:

As a second reminder, banks finance their assets with the money they have, i.e. their equity (which is essentially their accumulated profits) and with the money they don’t have but borrow on the financial markets and with… the generous deposits (generally non-interest bearing) of their customers.

When the banks’ big customers withdraw their cash, the managers of these banks are obliged to urgently find survival solutions. There are few of them…

The first solution would be to increase their equity by increasing their capital, which is what the managers of Silicon Valley Bank wanted to do, a solution that had the very big disadvantage of publicly confirming that this bank was on the verge of bankruptcy, and this is what precipitated this fatal outcome!

The second solution is to borrow billions of dollars on the markets, which leads to the same result!

The third solution is to sell off assets, the most liquid ones, including Treasury bills. The problem is that these securities then generate significant losses because of the increases in the Fed’s base rate, which went from 0 (zero) to 5% in one year, and this is what happened with Silicon Valley Bank!

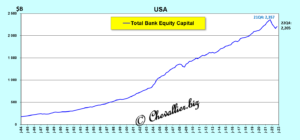

Conclusion: there is no solution to the bankruptcy of these banks, and those which have just sunk are only the first of a long series because it is the whole American banking system which is globally bankrupt, especially since the equity capital of the banks is globally very insufficient: 2,205 billion dollars at the end of 2022, the last figures published by our friend Fred of Saint Louis…

Document 8:

… for assets that amounted to $22,917 billion on May 10 (and $22,902 at the end of 2022) according to our friend Fred de Saint Louis,

Overall, the U.S. banking system gives the impression that it is healthy insofar as the total equity of $2,205 billion for $22,902 billion in assets corresponds to a leverage of just under 10.

However, the capital published by the banks does not give a true picture of reality because their real equity is that published as Capital Equity Tier 1.

This CET 1 is always significantly lower than the amount of equity published in the banks’ balance sheets.

On the other hand, some US banks are well managed. They therefore have equity well above the standards, which is not the case for many other banks.

Finally, as the amount of aggregate M3 money supply declines and will continue to do so for the foreseeable future, U.S. banks’ deposits will continue to decline overall, which will increase their deficits and the number of bank failures.

***

These aggregate data on the evolution of the monetary aggregates are obviously well known to the Fed’s leaders, as shown by the fact that they refuse to publish them as their predecessors did from the post-war period until February 2006.

Jerome Powell and his colleagues are therefore lying when they declare that the American banking system is healthy, which has particularly serious consequences…

Indeed, for the first time since the Great Depression of the 1930s, the United States is on the verge of a major crisis because the people of the Fed have voluntarily allowed undue monetary creation to develop, especially under the pretext of this coronavirus story.

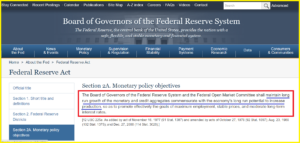

Yet the primary function of the Fed and FOMC leadership is to keep money healthy in the United States as Section 2A of the Federal Reserve System explicitly states,

Document 9:

The only positive aspect is that the suicidal policies being pursued by the deep state are opening a royal road to re-election for the Donald!

***

Click here to access the Investment Company Institute (ICI) data from documents 4 and 5.

Click here to read the Federal Reserve’s Section 2A release.

© Chevallier.biz