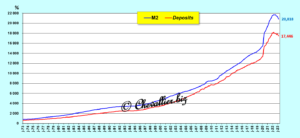

The decline in deposits in US banks has had the advantage of revealing that the variations in this mass of capital are identical to those in the M2 money supply and even in M3…

***

As a reminder, when Ben Bernanke took office as Chairman of the Fed in February 2006, he took care to stop the publication of the figures of the global money supply M3 so that no one, outside the restricted and confidential framework of the people of the Fed, could correctly analyze the origin of the crisis in the making, namely the money bubble created by the American banksters who no longer respected the prudential rules of indebtedness with leverage exceeding the standards.

The M3-M2 monetary aggregate was then well over 25% of GDP without economists being able to know it and draw the consequences that should have been imposed.

Subsequently, Jerome Powell also took steps to ensure that the public could not detect the lethal money bubble that was developing from 2020.

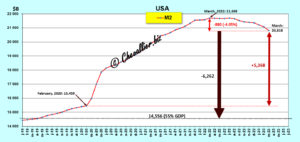

It was fueled by the distribution of over $5 trillion to Americans and businesses without the provision of work in return, under the guise of fighting this coronavirus story, which created a gigantic money bubble prominently displayed in the M2 monetary aggregate that reached an all-time high of $21.698 trillion at the end of March 2022.

Subsequently, this money bubble has been shrinking.

The decline in the M2 aggregate is relatively small: -$880 billion at the end of March 2023 (latest figures published by the Fed) since a high reached at the end of March 2022, which is indeed small but not negligible compared to the $21,698 billion of this historical high, i.e. -4.1% year-on-year!

Document 1:

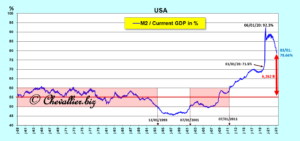

The ratio of M2 money to annual current GDP highlights the size of the money bubble that burst when the authorities forbade most Americans to work while generously and recklessly giving them over $5 trillion!

The ratio of the M2 monetary aggregate to annual current GDP (as a percentage) thus reached an all-time high of… 92% against a maximum of 55% according to standards (see below)!

Document 2:

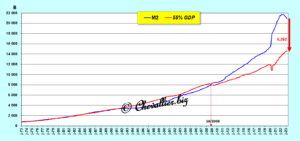

Normally, the money supply in circulation in a nation should grow at the same rate as current GDP, for simplicity and up to certain limits however, yet the increase in the M2 monetary aggregate has clearly exceeded the growth of this current GDP, especially after October 2008,

Document 3:

As the monetary aggregate M2 has been falling since the end of March 2022, this decline is reflected in the ratio of M2 to current annual GDP in percentage terms by a growth… negative for the first time since the post-war period at – 4.05%!

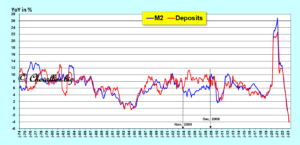

Document 4:

Now, juxtaposing the year-to-year changes in the M2 monetary aggregate and bank deposits shows that they have been identical, at least since the mid-1980s, except for a short period from November 2003 to December 2008, corresponding a priori to the banking bubble that gave rise to the Great Recession,

Document 5:

The year-on-year changes in the M2 monetary aggregate and bank deposits are identical, and this is a very useful surprise because it is now possible to know and predict (theoretically) changes in real GDP from the deposit data that are published weekly and monthly!

The monthly data of the M2 monetary aggregate and bank deposits over the long period do not allow us to highlight the concordance of their variations,

Document 6:

***

As a reminder, sound money is the first pillar of Reaganomics, according to Arthur Laffer, which means that there should never be undue money creation in a nation, i.e. a money bubble.

The problem is first to determine what is sound money and what are the associated concepts such as undue money creation and monetary hypertrophy…

A first simple and direct answer is the following: money is healthy in a nation when the money supply M3 is less than 80% of current (annual) GDP.

This is a so-called empirical ratio, i.e., it is determined after studying the changes in the monetary aggregates of a reference nation over a long period.

Only the United States provides such data, which can be easily downloaded through our friend Fred from Saint Louis.

From these data, it is possible to draw reasoned and therefore ordered conclusions linked to so-called theoretical contributions, in this case within the framework of monetarism, which is a well-established theory, in particular by Milton Friedman.

From then on, the lessons drawn from this empiricism are an integral part of a theory: monetarism.

To simplify, an analysis of the variations of the monetary aggregates M1, M2-M1 and M3-M2 in relation to annual current GDP (in percentage) shows that the optimum (or maximum!) corresponds to the following ratios…

The monetary aggregate M1, i.e., money in the form of greenbacks and positive current account balances of people living in the United States, should be about 15 percent of annual current GDP.

The M2-M1 monetary aggregate, corresponding to the money in savings accounts of these Americans, should fluctuate around 40 percent of this GDP.

The monetary aggregate M3-M2, the aggregate cash flow of U.S. businesses, is not to exceed 25 percent of this GDP.

Document 7:

Ben Bernanke and Jerome Powell have given the greatest importance to these monetarist ratios before and during a major crisis, by suppressing or modifying their publication.

They have shown that the analysis of the variations of these ratios is of the utmost importance… while all the Fed leaders since then, including Alan Greenspan, claim that they are no longer important!

Indeed, the analysis of the variations of the monetary aggregates allows us to highlight the variations of the real GDP because the variation of the real GDP is inversely proportional to that of the free money supply.

The variation of this free money supply is the difference between the variation of the M2 aggregate and (minus) the growth rate of real GDP, which will be the subject of the next article…

© Chevallier.biz