BNP-Paribas’ total derivatives amounted to more than… 30,000 billion euros at the end of 2022, which ranks these banksters as the fourth worst bank in the world!

***

The financial report of BNP-Paribas for the year 2022 publishes on page 69 a table summarizing their total derivatives under the usual name of notional amounts of derivative financial instruments classified as trading portfolio (in French!) which exceeds 30,000 billion euros taking into account other notional commitments,

Document 1:

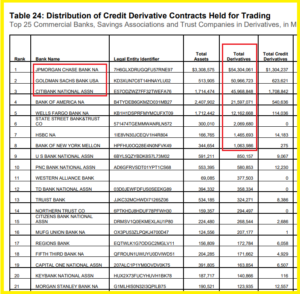

To give an idea of the importance of these BNP derivatives, one need only refer to the latest figures published by the US authorities, which show that BNP ranks fourth in this global ranking, i.e. after the three largest US banks, far ahead of Bank of America,

Document 2:

This document is published by the Office of the Comptroller of the Currency as of September 30, 2022, latest published figures, table 24 page 29, click here to see it.

Many Americans are worried about the importance of these derivatives of the biggest banks but almost nobody in France cares about it, with very rare exceptions…

The poor French are totally unaware!

Derivatives are financial instruments that play a very important role in reducing the risks that companies bear in the face of uncertainties in the foreseeable future but these commitments should not exceed certain limits.

It would be simple to impose the following rule on banks: derivatives should not exceed their total assets, for example, but the banksters have always been able to prevent the authorities from taking such a basic prudential measure.

Until now, financial products, when well managed, have generated few losses for some and conversely few profits for others, but in these times of unprecedented volatility, the losses can be gigantic for bad investors!

Moreover, another document in the financial report of BNP-Paribas is very frightening for any sensible person: the commitments given and received reveal that this bank has given commitments for 386.981 billion euros while the commitments received (guarantees) are only… 68.775 billion euros!

Document 3:

386.981 billion euros of off-balance sheet funding commitments guaranteed by… 68.775 billion lead to a potential loss of… 318.206 billion (at the end of the 4th quarter 2022)!

Monumental. Gigantic.

As a first reminder, according to the laws and regulations in force in the United States, all off-balance sheet commitments must be covered by guarantees.

As a second reminder, the only off-balance sheet assets of banks are the amounts of commitments made by their customers (companies) who ask them to pay for leasing transactions that they are likely to have to pay without delay.

The banks offer these services (because they are highly profitable) but they must obviously take out solid guarantees in case their clients are unable to repay them.

The guarantees obtained by BNP-Paribas are exceptionally far below basic logic (in the absence of legal obligations in Europe), which is potentially catastrophic.

Obviously, other corpses are hidden in the closets of these banksters but these two documents alone are enough to show once again that when this bank will fail, as it almost did in 2011-2012, it will be too late to act…

As a reminder, former BNP-Paribas banksters have admitted that, for several months in 2011-2012, they did not know, when they left their offices at night, if their bank would be able to open the next day…

Click here to (re)see the edifying film (but in French) of France 3 on the BNP banksters: BNP Paribas Dans Les Eaux Troubles De La Plus Grande Banque Européenne, usually censored after my articles because these BNP banksters are always watching me…

A movie to see and re-watch, while it is not censored.

As in 2011-2012, BNP-Paribas is very close to bankruptcy and it is not the only European bank in this situation…

***

Click here to access the documents published by BNP-Paribas as of December 31, 2022.

Click here to see the BNP-Paribas financial report from which 1 and 3 are taken.

Click here to see this article in French on me web site.

© Chevallier.biz