The M2 money bubble in the US is huge: more than $7 trillion of unearned money is still sitting unduly in the accounts of Americans…

***

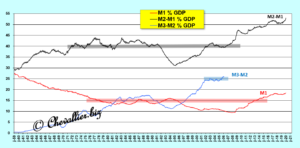

As a first reminder, sound money is the first pillar of Reaganomics, dixit Arthur, Laffer, which means that the ratios of monetary aggregates to current annual GDP (as a percentage) must not exceed certain limits that are derived from observing their evolution since the post-war period for the United States,

Document 1:

As a second reminder, the M1 aggregate corresponds to the sum of the banknotes in circulation that are supposed to be in the wallets of the population living in the United States and the total positive balances of the current accounts of these Americans.

M1 should be about 15 percent of current annual GDP.

M2-M1 is the total deposits of the population in interest-bearing savings accounts that can be debited without notice.

M2-M1 should fluctuate around 40 percent of this GDP.

M3-M2 is the total cash holdings of businesses.

M3-M2 should not exceed 25 percent of this GDP.

Indeed, when these ratios exceed these limits, a money bubble is created, which always causes serious dysfunctions.

It is therefore imperative that these ratios be scrupulously monitored and that the monetary authorities act as quickly as possible to burst any money bubble in the making, because if they act too late, the collateral damage would be lethal.

The US authorities (mainly the Fed) have always enforced this rule, more or less quickly, always creating a recession that is more or less serious but ultimately saving the day.

However, everything changed since the beginning of this coronavirus story when the American authorities decided to distribute thousands of billions of dollars to Americans to whom they forbade at the same time to work, which is contrary to all elementary economic logic!

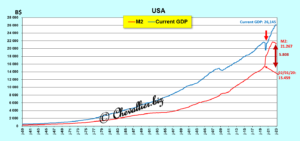

As a result, the ratio of the M2 monetary aggregate to current annual GDP (in percentage terms) exploded in 2022 (after starting to exceed the limits from July 2011),

Document 2:

Since the Fed’s data on these monetary aggregates have been published based on the same definitions (in 1959), never has such a monetary hypertrophy occurred because its leaders have always intervened to burst any money bubble that developed.

The graph showing the evolution of the M2 aggregate in dollars compared to GDP in current dollars also clearly shows this M2 money bubble,

Document 3:

The big problem for the US authorities is to burst this huge money bubble!

According to the statements of Jerome Powell and other former and current FOMC members, the measure that used to make it possible to burst a budding money bubble was (relatively) simple: it was enough to increase the Fed’s prime rate to the point of creating an inversion of the yield curve, which inevitably caused a recession that was more or less strong but sufficient to restore the right ratios.

However, this solution no longer works because the money bubble is too strong!

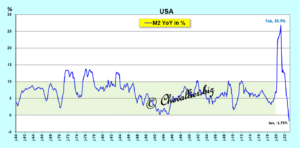

Indeed, the drop in the amount of the M2 aggregate is only… $473 billion at the end of last January compared to a high reached in March 2022 at $21,740 billion, a drop of only 2.17%, which is negligible compared to the norm.

Document 4:

Normally, the M2 monetary aggregate would have remained close to 55% of annual current GDP (which is $26,145 billion), or $14,380 billion, whereas it is $21,267 billion.

There is therefore $6,887 billion too much in the accounts of Americans, which constitutes a gigantic bubble.

These Americans still have too much money available in their bank accounts and they take advantage of this to spend some of it, which fuels demand and therefore supply.

Under these conditions, it is understandable that inflation is still off the charts and that the US economy is still operating at full capacity with a large number of jobs created and a historically low unemployment rate.

Jerome Powell and the members of the FOMC should therefore be obliged to note that the historically very fast and very strong increase in the Fed’s prime rate has no positive effect against this unprecedented inflation and that it does not create a recession, at least for the moment, but it will come in the near future!

So they don’t know what to do to bring down inflation (and economic activity) and there is no conceivable solution to burst such a monetary bubble!

The US authorities made a historic mistake at the wrong time, namely when they imposed sanctions against Russia on 27 February 2022 (by freezing, i.e. stealing, 300 billion dollars of Russia’s reserves), with the result that all the leaders of the major exporting countries (and holders of considerable dollar reserves) no longer have confidence in the dollar (USD).

The strength of the dollar (USD), thanks to the respect of the ratios of the monetary aggregates, had allowed America to keep its leadership on the world since the post-war period, which will not be the case in the future.

Sound money is indeed the first pillar of Reaganomics!

However, these interpretations may not correspond to reality…

Indeed, it is not credible that the Fed leaders could not admit that a strong and sustainable inflation had developed by the end of the year 2020, as clearly shown by the PCE indices, see my articles on this subject.

Therefore, we must consider another solution: the Fed’s leaders wanted to create a systemic crisis in the US but also worldwide, as part of the manipulation of public opinion by those currently in power in the US.

Another possible interpretation is that the proponents of Modern Monetary Theory (MMT) may have convinced the members of the FOMC that distributing unearned money would boost growth, as the rest of the world would continue to automatically finance external balance deficits with capital inflows…

Moreover, the year-on-year changes in the M2 monetary aggregate alone clearly show the emergence of this historical money bubble, but the drop into negative territory leads to misinterpretation, as the money bubble has not burst for all that!

Document 5:

Click here to (re)read my previous article on this subject (in French).

Click here to (re)read my basic article on the free money supply.

© Chevallier.biz