Many American banks are on the verge of bankruptcy, see my articles on this subject.

A small regional bank in Iowa was declared bankrupt by the FDIC on Friday October 3 (… after the stock market close!).

As of the evening of Sunday October 5, no article had been published in the media of reference (Bloomberg, Wall Street Journal) on this subject…

Citizens Bank is the fifth U.S. bank to fail this year, 2023, after Heartland Tri-State Bank, First Republic Bank, Signature Bank and Silicon Valley Bank.

According to an article in the Daily Hodl, Citizens Bank first suffered significant losses on certain loans (no further information is currently available on this point), and to make up for these losses, the bank was forced to sell Treasury bonds at a loss (due to the rate hike initiated by the Fed).

Citizens Bank thus ultimately fell victim to the same problems that led to the collapse of Silicon Valley Bank, namely unrealized but lethal losses on Treasuries not carried at fair market value.

Citizens Bank’s total assets were $66 million (only), which are being taken over in full (as of Monday) by another bank, Iowa Trust & Savings Bank.

An article in The Indian Express states that the FDIC’s Deposit Insurance Fund (DIF) (i.e. US taxpayers) will record a loss of $14.8 million (USD) on this bankruptcy.

All is well.

***

Document 1:

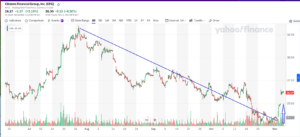

Citizens Bank’s share price has risen 12% in the last two trading sessions!

Document 2:

Citizens Bank’s share price had been falling sharply since a high at the end of July, but has suddenly jumped in the last two trading sessions!!!!

Document 3:

Since 2015, Citizens Bank’s share price has hardly risen at all,

Document 4:

***

Once again, I would like to thank my reader for providing me with this pertinent information on this case.

***

An article published in Yahoo Finance late on Sunday provides further interesting information on the Citizens Bank bankruptcy…

In fact, this tiny bank in a tiny town of 2,000 inhabitants (Sac City) was mainly involved in loans for the purchase of class 8 trucks (tractors), the largest vehicles in normal circulation in the United States, with prices ranging from $150,000 to $220,000,

This type of lending (in the USA and abroad) is out of the ordinary, and was already under the supervision of the authorities (Iowa Division of Banking, IDOB), who last August appointed Citizens Bank an “independent loan consultant” with full powers to manage this activity as best they could.

Four hours before the opening of the U.S. stock markets, neither Bloomberg nor the Wall Street Journal had published an article on this subject.

Click here to see Yahoo Finance’s Citizens Bank page.

Click here to see the FDIC page on the Citizens Bank bankruptcy.

Click here to see The Indian Express’ Financial Express page on Citizens Bank.

to see The Daily Hodl’s page on Citizens Bank.

Click here to see The Wall Street Journal’s Citizens Bank share price page.

Click here to access the Citizens Bank website.

© Chevallier.biz