American banks are publishing accounts that do not give a true picture of reality, which is worrying because many of them are actually bankrupt…

***

The principles of accounting rules (IFRS) are simple but imperative: companies must publish accounts that give a true and fair view of reality.

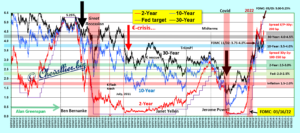

Thus, for example, assets must be recognized at fair market value, which was not a problem for securities acquired by banks as long as the Fed prime rate decided by FOMC members was stable, and this is what happened from 2009 to 2016.

However, from 2017 onwards, Fed officials were led to raise their prime rate moderately, but were forced to lower it rapidly and considerably in early 2020 (almost to… zero!) because of this coronavirus story,

Document 1:

As the contract prices of bond securities vary inversely with their yields, major gains have been made (in 2019 and especially 2020) on the prices of these securities thanks to cuts in the Fed’s prime rate, which have dragged down all other rates.

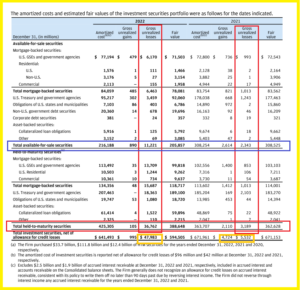

Contract prices, i.e. the amounts of the securities, then rose. These gains were not recognized (at fair market value) by the banks in 2019 and especially in 2020 (for $10.417 billion for JPMorgan),

Document 2:

In 2021, FOMC members left the Fed’s base rate at the floor (virtually zero percent), generating little variation in unrealized gains and losses.

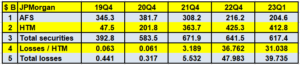

However, the Fed’s abrupt prime rate hike from March 16, 2022 resulted in gigantic unrecognized losses totaling… $47.983 billion for JPMorgan, as shown in this document published in Form 10-Q 2022!

Document 3:

For JPMorgan’s balance sheet closed at the end of the first quarter of 2023, total unrecognized losses have fallen a little, but are still considerable: $39.735 billion!

Document 4:

So, JPMorgan failed to recognize an actual loss of… $40 billion at the end of the first quarter of 2023… in perfect accord with the American authorities and accounting rules interpreted at their convenience by the… banksters all in one!

Accounting principles are not being respected, with impunity and with (almost) no one raising an alarm.

Furthermore, it’s abnormal that JPMorgan’s securities, starting at $392.8 billion at the end of 2019 have risen to reach two years later at the end of 2022… $671.9 billion by causing nearly $48 billion in losses… unrecorded!

Document 5:

JPMorgan’s executives have increased its held-to-maturity (HTM) securities from $47.5 billion at the end of 2019 to… $425.3 billion at the end of 2022, in order to minimize the losses booked without respecting accounting principles but in compliance with the rules accepted by the US monetary authorities (under the influence of these banksters!)!

40 billion of losses were not booked at the end of the first quarter of 2023, for a (fraudulently) published profit of $12.622 billion for this fiscal year and a Common Equity Tier 1 of $227.142 billion.

American bank accounts are no longer reliable.

The most influential banksters are imposing their solutions on the authorities who are supposed to control them.

The result of these accounting manipulations is that the US banking system is bankrupt overall, but is thus being artificially kept alive.

Why is it that no one is denouncing these accounting frauds, whose consequences could be catastrophic for the American people?

***

This article is a continuation of those published by Pam Martens on her Wall Street On Parade site. to read her latest article on this subject.

***

Document 2 is a screenshot of the fourth-quarter 2020 Form 10-Q on page 224.

Document 3 is a screenshot of the Form 10-Q for the fourth quarter 2022 on page 216.

Document 4 is a screen shot of the Form 10-Q for the first quarter of 2023, page 116.

© Chevallier.biz