The U.S. financial markets are being manipulated by big bank executives and the Fed as evidenced by the sharp rise in stock prices on Friday, May 13.

***

The stock markets suddenly turned around on Friday the 13th with abnormally high gains during the session with + 3.8% on the Nasdaq! … while the whole financial planet expected them to continue to plunge in their heavy trend that started in the first days of this year 2022.

No credible reason is given to explain this reversal which can only come from manipulations of the financial markets initiated by the people who dominate Wall Street…

The most influential of them are the leaders of the big banks that founded the New York Fed, and it is therefore also the leaders of the Fed who are acting in collusion with these banksters.

Indeed, the New York Fed enjoys a certain autonomy vis-à-vis the Washington Fed and, above all, its leaders can act in complete discretion, i.e. in secret. In addition, they benefit from significant financial means.

They have (officially) a trading room (the Desk) in New York and another one in Chicago (for the commodities markets) which allow them to buy and sell (in the greatest secrecy) securities on the markets and thus to… manipulate certain prices in concert with the leaders of the big banks, which should not happen, obviously!

The people at the Fed do not publish any information on these interventions.

Only Pam Martens of Wall Street on Parade publishes perfectly well documented articles on the actions of these banksters.

As a result, my recommendations were lost for this Friday the 13th! Bad luck…

Indeed, I wrote in my previous article: if my analyses are confirmed in the days to come, we must start positioning ourselves in anticipation of this crisis by investing in order to hope to triple our financial capital in a few months as in 2020!

The future is by definition uncertain but it is possible to reduce this uncertainty and to prepare to act positively when the time comes… and this time has already come, certainly without certainty but with a high probability of expectation of gains…

***

The S&P 500 went from an all-time high of 4,818.62 on January 4, 2022 to 3,858.87 at the end of the session on May 12, which corresponds to a 25% decline (over this period) but surprisingly recovered on Friday, May 13 when everyone expected the fall to continue!

Document 1:

Contrary to what all the useless idiots report, the markets were not oversold on the evening of May 12 justifying massive buying as shown by the Price / Earnings ratios which are all above the norm of 16 especially for those based on anticipated earnings,

Document 2:

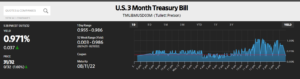

This rise in stock prices on Friday 13 May was logically accompanied by a rise in Treasuries yields, but in the greatest disorder, as shown by the numerous and wide-ranging variations in 3-month bill yields,

Document 3:

The variations in 2-year notes during the session also show sudden and ephemeral plunges every hour from 11 a.m. onwards, which is completely abnormal!

Document 4:

These abnormal variations are probably the result of poorly controlled manipulations on these markets, and the same was true of the equity markets, especially for the most volatile stocks, which are the most overvalued.

***

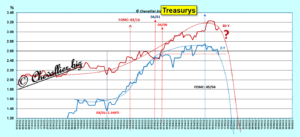

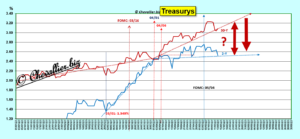

The 2-year ratings have fallen abnormally while the ratings on the other maturities, long (from 5 years to 30 years) and short (the 3 months) have risen abnormally, all in line with the trend curves I have drawn,

Document 5:

This drop in the 2-year and this rise in the 30-year accentuates the opening of the angle of a pair of scissors whose axis is at April 1 (whose two branches should fall),

Document 6:

As I wrote earlier, it is too early to give reliable explanations for the delay in the FOMC members raising the Fed’s prime rate (yields on 3-month bills should have been close to those on 2-year notes).

It is possible that they did so to create a crisis as soon as possible so as to burst the money bubble that has developed in the United States,

Document 7:

The 30y-2y spread has thus soared, again in perfect agreement with the trend line I drew,

Document 8:

As a reminder, this 30y-2y spread (which is the difference between the yields of 30-year notes and those of 2-year notes) best represents the evolution of the American cycle,

Document 9:

The 6th order polynomial trend line also shows the same upward trend,

Document 10:

A crisis is dramatic for bad investors, but a crisis is a good opportunity for good speculators, those who see right and far, from data that provide a true picture of reality and not from assumptions and verbal words…

***

tonparade.com/2022/05/scandalized-dallas-fed-keeps-it-all-in-the-family-with-appointment-of-lorie-logan-as-president/”>Click here to read a recent article by Pam Martens on Wall Street On Parade that summarizes her previous articles about the Fed’s untimely intervention in the markets with the big banks.

Click here to read my article on my investment strategy as of May 11th (in French).

© Chevallier.biz