Abstract

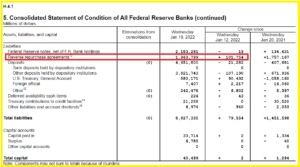

In their latest balance sheet released on January 20, Fed officials increased the amount of reverse repurchase agreements to as much as $1,963.799 billion next week.

If reverse repos reach such a high level, it means conversely that US banks are running out of liquidity for roughly the same amounts because the interbank market is a zero-sum market.

This situation is consistent with a financial and banking crash that could be triggered by a surprise increase in the Fed’s prime rate at the January 26 FOMC.

***

The Fed’s weekly balance sheet for January 19 shows that reverse repurchase agreements jumped by $101.754 billion (from the previous week) to $1,963.799 billion, meaning that Fed officials expect reverse repos to reach that amount in the current week (ending January 26),

Document 1:

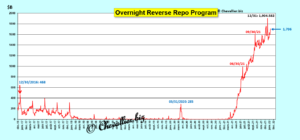

This would be an all-time high for these reverse repos, which have been on the rise again since Wednesday, January 19,

Document 2:

As a reminder, reverse repos are operations carried out by the New York Fed, which consist in taking overnight liquidity from commercial banks that do not need it by lending them Treasury bills in exchange, in order to reduce their balance sheet total (because these Treasury bills, in repos, are not accounted for in the balance sheet), which therefore allows these banks to improve their leverage, see my previous articles on this subject.

Fed officials had done the same at the end of 2021,

Document 3:

It is usual (and understandable) that at the end of the quarter the managers of some US banks that are flush with cashseek to get their excess liquidity off their quarterly balance sheet to publish leverage within the norms, but it is quite unusual that they do so during the quarter.

A logical explanation for this incongruity is that by deciding to raise the Fed’s prime rate by 25 basis points (or even 50) as early as January 26, the date of the next FOMC meeting, its members are going to create a shock on the financial markets, which will collapse!

As a result, banks that were already short of liquidity and were forced to borrow billions of dollars from the New York Fed will be forced to borrow even more.

Since any nation’s interbank market is a zero-sum market, the need for liquidity corresponds inversely to the excess liquidity, namely the reverse repos, which are set to possibly reach $1,964 billion according to the Fed’s latest balance sheet.

The data for repos and reverse repos from September 2019 to the end of June 2020 clearly show this inversion (their matching on this chart),

Document 4:

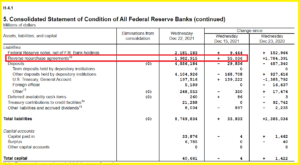

The problem is that Fed officials have decided to stop publishing data on the liquidity they provide through repos to rescue banks that are short of it.

In fact, they use other procedures for which they are not obliged to publish the data. These are the Primary Dealer Credit Facility (PDCF), Commercial Paper Funding Facility (CPFF), Money Market Mutual Fund Liquidity Facility (MMLF).

So the leaders of the Fed (in Washington and New York) are colluding with their banksters to secretly provide them with liquidity so that they don’t go bankrupt right away!

This is an important issue raised in particular by Pam Martens in her articles on the Wall Street On Prade site.

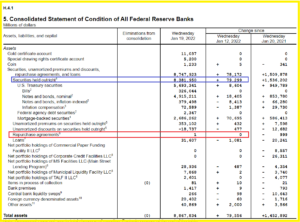

For the record, copy of the repos and reverse repos for this January 21…

Document 5:

…and Fed assets confirming that repos are at (almost) zero: $1 million!

Document 6:

***

My analyses and projections allow me to reduce the uncertainty of the financial markets in the face of the future, which allows me to anticipate their evolution based on reliable data and to draw the right conclusions that feed the winning speculation…

Within the framework of the Investment subscription, I give investment proposals for anyone wishing to save and even enhance their financial assets, especially when the foreseeable crash will occur in the near future and the facts prove me right once again: losing investments, especially on derivatives, lead to fire sales, including by big banks, some of which are in perdition!

My articles and advices bring some order in the great disorder that reigns on the financial planet…

***

tonparade.com/”>Click here to access the Pam Martens Wall Street On Parade website.

Click here to access my French site.

© Chevallier.biz