Abstract

Large US banks and hedge funds have suffered heavy losses, especially on derivatives. They lack liquidity.

Only the Fed is providing them with liquidity, but it refuses to communicate the data that would make it possible to know the amounts of these contributions and the names of these financial institutions that pose a systemic risk to America.

This article deciphers these accounting manipulations…

***

As a reminder (or for information), every (working) day, banks carry out a very large number of transactions, in particular payments, issued and received. In order to do so, they must have sufficient liquidity.

Each day, after the close of each session, all banks in each nation must have a net credit position with their central bank.

However, it is common (and normal) for some banks to have a net debit position with their central bank on certain days for one or more days. They can then borrow cash from banks that have a net credit position with their central bank from one day to the next (by providing collateral, usually Treasury bills), which is normal. This is what constitutes the interbank market.

However, at the beginning of the 21st century, we are seeing that far too many American banks (from the United States) have a net debit position for a long time (for several months), especially during a crisis (or a recession), and for significant amounts. The managers of banks that have a net credit position with their central bank then refuse to lend liquidity to banks that have a net debit position (with their central bank) because they no longer have confidence in banks that are short of liquidity.

Under these conditions, the interbank market no longer functions because there is no longer any trust between the managers of American banks, who all go through the intermediary of the Fed.

Thus, banks that have a net credit position with their central bank deposit their excess liquidity with the Fed, which gives them securities under repurchase agreements in return, which is recorded in reverse repos (on the Fed’s liabilities side).

Conversely, banks that have a net debit position with their central bank request liquidity from the Fed by providing securities as collateral (Treasury bills or mortgage-backed securities), which is recorded in repos (in the Fed’s assets).

The Fed publishes aggregate data on these repos and reverse repos every day and a discontinuous series of their data starting in July 2000. For example, after the September 11, 2001 attacks, the Fed provided $81 billion to banks. The same was true during the Lehman Brothers bank failure: the Fed provided $50 billion for a few days (from one day to the next).

However, starting on September 17, 2019, Fed officials agreed to provide liquidity for much larger amounts every day until early July 2020: up to $143 billion on March 23, 2020!

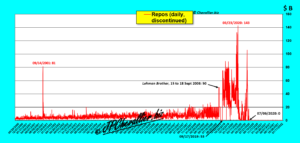

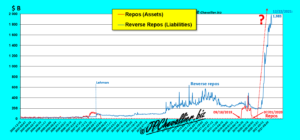

Document 1:

This first graph represents the amounts of repos accepted each day by the Fed without taking into account the duration of the loans, which are not all from one day to the next, but can be for a period of 14, 28, or even 42 days (from one business day to the next).

Given the published data, it is tedious to calculate for each day from September 17, 2019 to July 6, 2020 the total reached each day by the amounts of these loans.

However, the Fed publishes in its weekly balance sheets closed each Wednesday night (in its assets) the projected amount of such repos that can be accepted in the coming week and they are very close to what they then actually reach.

So, for example, the Fed published in its March 18, 2020 balance sheet a total of… $441.945 billion under Repurchase agreements, which means that the Fed’s loans to its banksters reached such a total during the week of March 18-25, 2020 under the so-called repo procedure (adding up all outstanding repos, regardless of their duration on that date)!

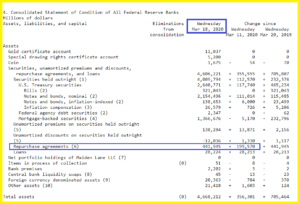

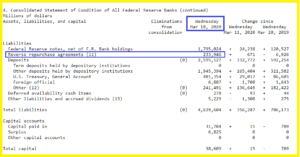

Document 2:

Since our friend Fred from St. Louis publishes the data series for this item on the Fed’s balance sheet (Repurchase agreements), it is possible to obtain a very close estimate of the totals of the sums actually lent by the Fed to its banksters over the period from July 2002 to January 5, 2022.

Thus, the Fed lent continuously every business day a total of more than… $150 billion from October 2, 2019 to May 20, 2020, going up to… $442 billion in the week beginning March 18, 2020!

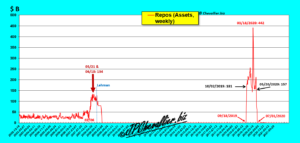

Document 3:

The Fed has the very big disadvantage of publishing each day only the amounts of repos and reverse repos accepted without mentioning the names of the banks concerned or the amounts requested. This information is only made available after a two-year delay (according to one of the many provisions of the Dodd-Frank Act) as shown in the document published by the Fed on December 31, 2021.

Document 4:

It is therefore only possible to identify the banksters who are the beneficiaries of these Fed bailouts two years after they have taken place. Thus, this information is not known for two years, which allows these banksters to continue to benefit from these billions of dollars in the greatest secrecy and with impunity. American citizens should know the real situation of the American banking system without waiting two years!

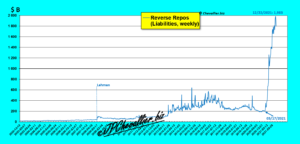

The data published daily by the Fed on reverse repos (i.e. for deposits made on a daily basis by banks that have a net credit position with their central bank) show that they have jumped prodigiously with the development of this coronavirus story to the point of reaching an all-time high on December 31, 2021 at… 1,983 billion dollars (without it being possible at present to identify these banks)!

Document 5:

As a reminder, since the beginning of July 2021, the Fed has been issuing zero repos, suggesting (falsely) that the banksters no longer need the Fed’s liquidity inflows.

This is of course an unmistakable deception because the Fed has set up three new procedures allowing it to lend large sums to its banksters without publishing any data in order to deceive the public and protect these banksters: Primary Dealer Credit Facility (PDCF), Commercial Paper Funding Facility (CPFF), Money Market Mutual Fund Liquidity Facility (MMLF)!

The grouping on the same graph of the evolution of repos and reverse repos since 2002 on a day-to-day basis highlights an important fact: in the event of a crisis, such as in 2008-2009, the amounts of repos exceed those of reverse repos before and after this crisis.

Document 6:

A zoom on this period highlights this problem,

Document 7:

Logically, by transposing the data from the past, the same could therefore have happened in 2020 and 2021 and still currently so that the amounts of repos could possibly have reached, or even exceeded, $2 trillion by the end of 2021!

Document 8:

Again a zoom in on this period highlights this problem,

Document 9:

This interpretation of the data on repos over this period impacted by this coronavirus story is all the more plausible since the people at the Fed have obviously sought to avoid communicating the data on the loans they have granted to their banksters by blocking the data on repos at zero since July 7, 2021, while admitting to having launched three other liquidity programs without communicating any data whatsoever, thus in the greatest secrecy to the benefit of these banksters and to the detriment of the Americans.

The executives of the big banks that benefited from these rests (and the new schemes that replaced them) without being identified thus gain an undue advantage that encourages them to perpetuate this dangerous situation for them and for the nation without seeking to increase their liquidity or to reduce the risks they incur, with impunity.

They therefore benefit from moral hazard. In effect, they run significant (systemic) risks to the nation because of the colossal overall amounts of their net debit positions with the central bank.

The American banking authorities, in particular the Fed’s leaders (the members of the FOMC), are obviously in guilty collusion with these banksters because they do not take into account the interests of the nation but only those of the imprudently managed banks.

This behavior is explained by the fact that most of the members of these authorities are in fact closely linked to the executives of the big banks who have always shown that they know how to be grateful to them after leaving their official functions…

The US banking system is malfunctioning as evidenced by the fact that the interbank market is no longer functioning, especially since September 17, 2019.

To solve this problem, the best solution would be to oblige the US authorities to publish without delay (every day) the complete data on repos and other equivalent arrangements (as for repos and reverse repos currently stopped on December 31, 2019) without waiting for the two-year deadline provided by a provision of the Dodd-Frank Act.

Thus, everyone would know the names of the bad banks and the amounts of the contributions from which they unduly benefit, which would force their managers to reduce their commitments as soon as possible, in particular on derivatives, by restoring normal ratios.

***

As a reminder (or for information), in a nation with its own currency, each day, after the close of each session, all its banks must have a net (small) credit position with their central bank. Under these conditions, this banking system is balanced.

When this equilibrium is globally disrupted for a certain period of time, the imbalances necessarily compensate each other, at least apparently and not permanently.

Indeed, the overall lack of liquidity of banks with a net debit position vis-à-vis their central bank is necessarily and logically offset by the excess liquidity of banks with a net credit position vis-à-vis their central bank. In this case, the banking system is not permanently balanced by the inversion of these imbalances!

It is the accumulated deficits of banks in a net debit position with their central bank that pose a systemic risk to this banking system, as soon as these dysfunctions produce excessively large negative effects on non-financial enterprises and therefore on the general economic system of this nation.

For example, in the case of a normally functioning banking system, all payments issued by banks are globally offset by payments received by other banks because money circulates quickly.

On the other hand, when some banks accumulate large losses corresponding to large gains for others, for example in the case of poorly traded derivatives, the losing banks accumulate lasting net debit positions (vis-à-vis their central bank) that are difficult to recover and that correspond to the lasting net credit positions (vis-à-vis their central bank) of the winning banks on these derivatives.

These dysfunctions have clearly been affecting a number of US banks since mid-September 2019, which is amplified by hedge funds (because of the leverage they routinely use without supervision) and the commitments involving huge sums of money allowed by the means of financing from the hypertrophied Eurodollar markets.

***

The Fed people obviously wanted to deceive the American people by stopping publishing the repos figures as of July 7, 2020 in order to hide the lack of liquidity of some American banks that have been supplied with dollars by other devices for which they do not want to publish the data: Primary Dealer Credit Facility (PDCF), Commercial Paper Funding Facility (CPFF), Money Market Mutual Fund Liquidity Facility (MMLF).

The Fed therefore publishes a balance sheet that does not give a true picture of reality in which the Repurchase Agreements (repos) are at zero.

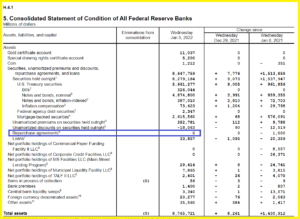

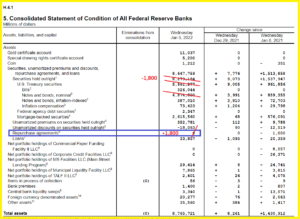

Document 10:

In reality, the people at the Fed should have recorded, for example, at least 1,800 billion dollars in repos (see document 9) under the heading Repurchase agreements and they should have reduced the amounts of securities (Securities… Notes) by the same amount in compensation because these securities are in fact held by the Fed as collateral for these 1,800 billion lent.

Document 11:

In fact, the people at the Fed allocate a priori in the assets under the heading Repurchase agreements the sums that are likely to be lent during the coming week, which reduces the value of the Treasury bills owned in full because they are then allocated to these repos. This is the result of basic accounting logic.

The people at the Fed have created new devices to avoid publishing the amounts of their contributions to the banks that lack liquidity, which is an admission (and a confirmation) of their manipulations to hide the truth from the Americans and the financial markets in general. These are reprehensible practices, not condemned or even sanctioned…

***

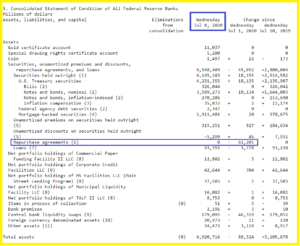

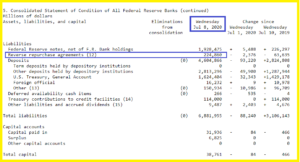

For the record, the Fed’s liabilities as of March 18, 2020 correspond to the assets published above in Document 2.

Document 12:

As of July 8, repos have officially fallen to zero to date…

Document 13:

…while reverse repos continued to fluctuate in the $200 billion range.

Document 14:

***

Much of the issues discussed in this article are taken from Pam Martens’ articles on the Wall Street On Parade site, particularly the one from January 10, tonparade.com/2022/01/on-march-31-the-fed-has-to-name-names-under-four-of-its-emergency-loan-programs-to-wall-street-will-the-media-censor-that-news-also/”>click here to access it.

Click here to access the Fed’s Overnight Reverse Repo (Facility) Program (ON RRP) publishing daily repo and reverse repo data.

Click here to access our friend Fred’s St. Louis series on repo data from the Fed’s Repurchase Agreements liability section.

Click here to access our friend Fred de Saint Louis’ series on reverse repos data from the Fed’s Reverse repurchase agreements section of the Fed’s assets.

Thank you to the reader of my site who brought to my attention articles, especially by Pam Martens and others on these issues that are not covered in the so-called mainstream media.

© Chevallier.biz