To increase the wealth of nations and their inhabitants, it is necessary to maintain a long-term growth of monetary aggregates in proportion to the potential growth of real GDP…

***

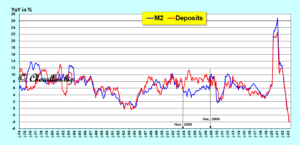

Undue monetary creation has been developing in the United States since at least 2011 and this money naturally and logically ends up in deposits on the accounts of the banks’ clients, i.e. on their liabilities, thus financing their assets.

The US monetary authorities have finally intervened to bring down this money bubble, which peaked in 2022, as can be seen in the data of monetary aggregates and in the data of the deposits of the customers of US banks…

This decline in bank customer deposits is still going on and has passed the symbolic threshold of… $1 trillion to reach $1,035 billion on May 10, the latest figures published by our friend Fred from Saint Louis,

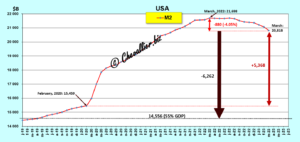

Document 1:

This decline in deposits has been accentuated in recent months with the failures of three U.S. banks as many customers have withdrawn their money from their banks: $568 billion has left bank deposits to take refuge in money market funds,

Document 2:

Indeed, deposits in money market funds increased by $521 billion during the same period according to weekly data published by the Investment Company Institute (ICI) as of May 17, the latest figures published!

Document 3:

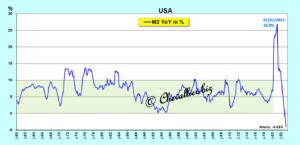

The money bubble that developed from 2020 onwards was fueled by the distribution of more than $5 trillion to Americans and businesses without the provision of work in return, under the pretext of fighting this coronavirus story, which created a gigantic money bubble well evidenced in the M2 money aggregate that reached an all-time high of $21.698 trillion at the end of March 2022 that fell by $880 billion at the end of March 2023 (latest figures released by the Fed)!

Document 4:

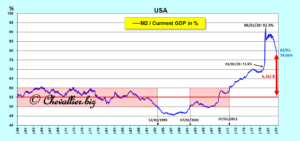

The ratio of M2 monetary aggregate to annual current GDP (as a percentage) has thus reached an all-time high of… 92% versus a maximum of 55% by standards!

Document 5:

As the M2 monetary aggregate declines since the end of March 2022, this decline is reflected in the ratio of M2 to annual current GDP as a percentage by a growth… negative for the first time since the post-war period at – 4.05%!

Document 6:

Juxtaposing the year-to-year changes in the M2 monetary aggregate and bank deposits shows that they have been identical, at least since the mid-1980s, except for a short period,

Document 7:

***

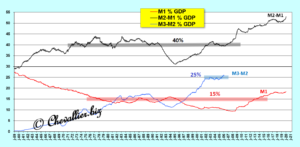

To simplify, an analysis of the changes in the monetary aggregates M1, M2-M1 and M3-M2 relative to annual current GDP (in percentage terms) shows that the optimum (or maximum!) corresponds to the following ratios:

The monetary aggregate M1, i.e., money in the form of greenbacks and positive current account balances of people living in the United States, should be about 15 percent of annual current GDP.

The M2-M1 monetary aggregate, corresponding to the money in savings accounts of these Americans, should fluctuate around 40 percent of this GDP.

The monetary aggregate M3-M2, the aggregate cash holdings of U.S. businesses, should not exceed 25 percent of this GDP.

Document 8:

Ben Bernanke and Jerome Powell gave the greatest importance to these monetarist ratios before and during a major crisis… by suppressing or modifying their publication!

They have shown that the analysis of the variations of these ratios is of the utmost importance… while all the Fed leaders since then, including Alan Greenspan, claim that they are no longer important!

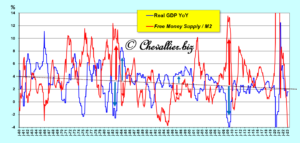

Indeed, the analysis of the variations of the monetary aggregates allows us to highlight the variations of the real GDP because the variation of the real GDP is inversely proportional to that of the free money supply.

The change in the free money supply is the difference between the change in the M2 aggregate and (minus) the growth rate of real GDP

Document 9:

In conclusion, in order to increase the wealth of nations and their inhabitants, it is necessary to maintain long-term growth in monetary aggregates in proportion to the potential for growth in real GDP as the Federal Reserve Act has made clear…

Document 10:

As a reminder, sound money is the first pillar of Reaganomics, according to Arthur Laffer, which means that there should never be undue money creation in a nation, i.e. a money bubble.

© Chevallier.biz