The French journalist Pierre Jovanovic was amazed by the dynamism of Turkey and he drew praise for the Turks.

I present in this article the reasons for Turkey’s economic success over the last few years: growth is strong in Turkey thanks to its banks which respect the prudential rules of indebtedness (see my previous article on this subject) and thanks to the Central Bank which respects the accounting rules without making undue monetary creation…

This article deals with Turkey’s money supply and its aggregates.

As a reminder, the M1 aggregate corresponds to the liquid assets of households, which are made up of banknotes and the outstanding amounts on their current accounts.

The mass of deposits on household savings accounts constitutes the M2-M1 aggregate.

The monetary aggregate M3-M2 corresponds to the total cash holdings of businesses.

The money supply M3 is the sum of these three aggregates. It is the total amount of money that circulates in a nation.

***

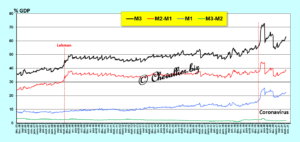

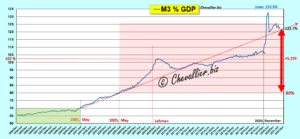

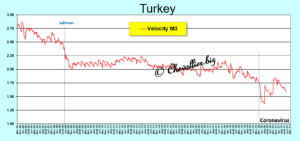

The first concept to consider is the ratio of the money supply M3 to the current annual GDP in percentage.

This ratio should be as low as possible. It must always be below 80%.

This condition is necessary for money to remain healthy in a nation (without undue money creation), which is the first pillar of Reaganomics, according to Arthur Laffer, and it is respected in Turkey,

Document 1:

The counter-example is that of the euro zone: before the adoption of this unnatural single currency, the member countries of this zone generally respected this condition,

Document 2:

The growth of most of the countries in this zone has considerably weakened since the adoption of the euro because of the undue money creation, ex nihilo, practiced by the ECB leaders, which I have deciphered well in many articles…

A M3/GDP ratio lower than 70% allows to optimize the growth of the real (deflated) GDP, i.e. the wealth created by the inhabitants of this nation.

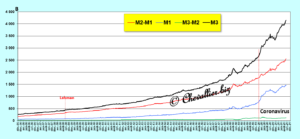

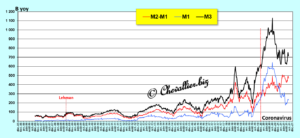

More precisely, the relationship between the growth of the money supply M3 and the real GDP is as follows: the variation of the real GDP (from one year to another in percentage) is inversely proportional to that of the free money supply, which is clearly visible on the graph representing these data series provided by the Central Bank of Turkey since 2006,

Document 3:

I define the free money supply as the difference (in percentage) between the change in the money supply M3 and (minus) the change in the current GDP (always from one year to another), which means that if this money supply increases faster than the current GDP, undue money creation occurs which results in a decrease in the real GDP.

This is precisely what happened in Turkey in 2009 (due to the Great Recession in the United States following the bankruptcy of the Lehman Brothers bank), in late 2018-early 2019 and in 2020 with this coronavirus story.

Conversely, when the free money supply grows slower than the current GDP, money circulates faster, which results in an increase in real GDP, which has happened in Turkey several times more or less sharply between these recession periods.

As inflation is high in Turkey, the dividing line (between these two entities) is also high and so is real GDP growth, which does not happen when inflation is low, of course.

The increase in the money supply M3 (year on year in billions of Turkish liras) is very high, increasingly high thanks to (or because of) the high inflation which encourages Turks to spend their money or to invest, which has no harmful consequences because the fundamental ratios (bank leverage and M3/GDP) are respected!

Document 4:

The monetary aggregate M3-M2 is particularly and abnormally low. It corresponds to the overall cash flow of Turkish companies, which are therefore generally in a tight situation.

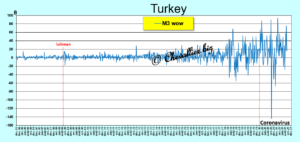

The variations of the M3 money supply from one week to the next are very strong: from + 100 billion liras to – 140 billion as in the United States, which shows the spontaneous reactivity of Turks to very short-term variations in economic activity,

Document 5:

This indicator is also a seismograph that gives a good account of the exacerbation of tensions in Turkey, and it was the same in the United States when the Fed published these data.

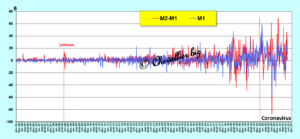

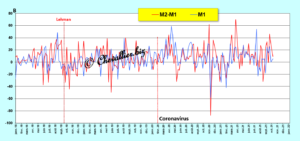

The week-to-week changes in the M2-M1 and M1 monetary aggregates are also very strong during periods of severe financial turbulence,

Document 6:

These week-to-week variations in these two aggregates are not systematically opposite to each other, as was the case in the United States when the Fed published its figures,

Document 7:

In absolute values, in billions of Turkish liras, the variations of these aggregates are increasingly strong, especially with this story of coronavirus: the Turkish authorities have made the same mistake as their counterparts in many other countries by distributing money to Turks without any wealth creation in return, which creates a particularly dangerous monetary bubble!

Document 8:

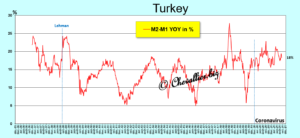

The money supply M3 increases by 17% year on year, which is of the same order as the inflation rate, thus maintaining the M3/GDP ratio at an optimal level,

Document 9:

The abnormally large increase in the M1 aggregate because of this coronavirus story is well highlighted on this graph, which represents its year-to-year (week-to-week) variation in percentage terms, but the situation is returning to the norm,

Document 10:

Turks increased their savings significantly after the Lehman Brothers bank failed in September 2008 but then the fluctuations in savings (year on year, week on week) are explained by considerations specific to Turkey,

Document 11:

Turkey’s strong real GDP growth is therefore mainly explained by the fact that money circulates quickly there: Turks earn money by working and they spend it quickly (or invest) thanks to (or because of) high inflation, which translates into high demand that stimulates supply, which fuels a virtuous cycle of strong self-sustaining growth,

Document 12:

The counter-example is provided by the Eurozone countries: the unfortunate Euro-zoners are afraid of everything, of the coronavirus and of anything, which encourages them not to spend the money they receive, either by working or by… not working!

Under these conditions, money does not circulate, or circulates badly and little, which blocks the growth of the real GDP at a very low level, even negative…

Everything is simple.

***

The data of the monetary aggregates are those published by the Central Bank of Turkey, click here to access them.

The GDP data of Turkey are those of our friend Fred de Saint Louis, click here to access them.

Click here to access the website of our friend Pierre Jovanovic to read among others his articles on Turkey with his video on the same subject (all in French).

© Chevallier.biz