The French journalist Pierre Jovanovic published reports praising Turkish banks and the growth of this country inhabited by a large majority of Muslims.

Indeed, Turkey’s fundamentals are… perfect because the Turkish banks respect the prudential rules of indebtedness and the Central Bank’s managers respect the accounting rules!

Consequently, Turks should benefit from this.

This is confirmed by the analysis of some economic and financial concepts…

***

Thanks to its good fundamentals, Turkey’s real GDP growth has been in the range of 4-5% year-on-year since the beginning of the statistics published by Fred of Saint Louis calculated on a dollar (USD) basis by the OECD,

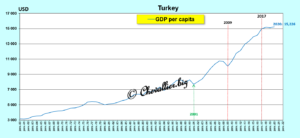

Document 1:

4 to 5% real GDP growth was the growth rate of France during the 30 Glorieuses (1945-1975)!

It is very likely that the rate of this growth is actually even higher for Turks making these calculations in the national currency, the lira.

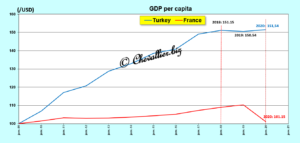

What matters to the Turks is the improvement of their standard of living, which corresponds in statistics to the GDP per capita (GDP per capita, since 1960) that shows significant increases from 2001 onwards (i.e. from the coming to power of the parties claiming to be Recep Tayyip Erdoğan and Islam) interspersed with a break caused by the repercussion of the Great American recession in Turkey,

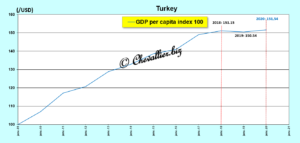

Document 2:

To facilitate the understanding of this increase in GDP per capita, the graph representing its evolution on the basis of an index 100 year 2009 shows that Turks have increased on average by more than half their available wealth per person created in one year!

Document 3:

For comparison, in 2020, France’s GDP per capita has only increased by… 1% in 11 years!

Document 4:

On a base of 100 in 1960, France’s real GDP growth (year on year has always been higher than Turkey’s until 200 9 but then it remained stuck at that level while the Turks’ has exploded.

9 but then it remained stuck at that level while the Turks’ has exploded.

Document 5:

The only shadow in this picture of Turkish success is inflation, all the useless idiots will say.

On a base of 100 in 2015, prices of non-volatile products have more than doubled from that base to the end of August, the latest published figures,

Document 6:

Price increases for these products have fluctuated from 8% to 24% year-over-year, on a downward trend currently  at 16%,

at 16%,

Document 7:

In fact, on the basis of Turkish data, it appears that an inflation considered to be lethal of the order of 10 to 20% has finally positive effects overall because all economic agents (households and companies) have an interest in circulating money quickly (see my previous article on this subject), which boosts real GDP growth… provided that the fundamentals are respected (see banks and monetary aggregates)!

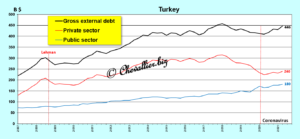

Turkey’s overall debt (that of the state and the private sector) is particularly low: 62% of current GDP ($720 billion at the end of 2020), with public debt representing only… 25% of current GDP!

Document 8:

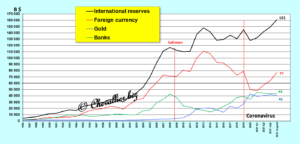

Here again, Turkey’s success is total as shown by the international reserves that continue to grow despite the attacks on Turkey in the political arena!

Document 9:

Turkey’s success is also that of an energetic politician who has managed the Turkish res publica correctly, namely Recep Tayyip Erdoğan who continues in his own way the recovery of this nation after the impetus once given by Mustafa Kemal Atatürk.

It should not be forgotten that Istanbul was previously known as Constantinople, the capital of the Ottoman Empire which succeeded Byzantium as the capital of the Byzantine Empire, i.e., the empires dominating since the beginning of the 4th century almost without discontinuity…

Some of the data used in this article may be subject to bias because some of the available statistics are calculated using the dollar, USD.

For example, since the parity between the dollar, USD and the Turkish lira, TRY has undergone large variations to the detriment of Turkey (mostly due to inflation), the GDP per capita for Turks remaining in their country is possibly understated.

Document 10:

***

The data used in this article are from the Central Bank of Turkey and Fred of Saint Louis, as before.

© Chevallier.biz