Abstract

The Turkish lira continues to lose value against hard currencies, which is beginning to present many problems.

One solution is to allow Turks to open tax-free savings accounts on condition that the money is invested in Turkish securities and not to tax the income of Turks’ capital invested in Turkey.

In this way, the currencies (for 200 to 300 billion dollars) that Turks possess should logically return freely and spontaneously in Turkish liras without increasing the prime rate of the central bank.

***

Everyone agrees: the 10-20% inflation in Turkey is lethal and the central bank must increase its prime rate (above this rate) to create a crisis that will bring down this inflation as the Americans did in the 70-80s and Recep Tayyip Erdoğan is most wrong to oppose it.

Yeah, is this reasoning, right?

Inflation considered normal and even ideal (by the doxa, i.e. by all economists) must be in the range of 1.0 to 2.0% from one year to the next, on the one hand (more than 1.0%) so that there is no risk of deflation and on the other hand (less than 2.0%) so that there is no risk of hyperinflation which, once gone, would be hard to control.

So be it, but in Turkey, real GDP growth (deflated) has been 4 to 4.5% from one year to the next for the last twenty years…

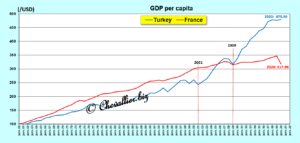

Document 1:

…which benefits the Turks whose GDP per capita has increased by half since the end of the 2009 crisis (imported from the United States) while the French have not benefited from any additional wealth during the same period!

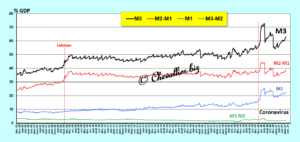

Document 2:

On the other hand, the French have benefited from a very important increase in their standard of living and full employment during the 30 Glorieuses (1945-1975) while inflation was well above 2% with many devaluations against the so-called strong currencies.

So, would high inflation (well over 2% per year) in a nation benefit the whole population?

Yes for Turkey for the last twenty years, yes for France during the 30 Glorious Years (45-75) and once for other countries such as Italy and Spain among others.

However, the loss of value of the Turkish lira over the last twenty years or so in relation to the so-called major currencies is currently beginning to cause damaging dysfunctions for the Turks.

These problems do not stem specifically from inflation but from the bad reaction of Turks who prefer to invest their financial capital in currently strong currencies (USD, euro) instead of in Turkish securities or directly in value-creating projects in Turkey.

This flight of indigenous capital by a part of the Turkish population (in the order of 200 to 300 billion dollars) artificially and abnormally accentuates the fall of the national currency (in relation to the strong currencies).

To remedy this problem, relevant solutions exist…

Turks who invest their savings in foreign currencies (without investing this capital) do so because they anticipate a loss in the value of the Turkish lira by the amount of inflation, i.e. by 10% per year for example.

However, a capital invested in Turkey returns a priori about 5% on average per year excluding inflation, which makes an increase of 15% finally (in nominal value) after one year.

Productive investment in Turkey is therefore more profitable than any investment in foreign currencies… provided that this capital income is tax-exempt, of course (which capital invested in foreign currencies is not).

One solution (to the disadvantages posed by the loss of the value of the Turkish lira) is therefore to give Turks the possibility of opening tax-free savings accounts, provided that this money is invested in Turkish securities, and not to tax the income from capital (of Turks) invested in Turkey.

In this way, the currencies (for 200 to 300 billion dollars) that Turks possess should logically return freely and spontaneously in Turkish liras for the greatest benefit of their owners and Turkey, without additional costs, and with additional wealth creation in Turkey.

A solution of this type has the advantage of being a priori efficient and of being part of a well-ordered economic liberalism for the greatest benefit of the nation.

The foreseeable increase in foreign exchange reserves recovered by the central bank would then strengthen the lira against hard currencies, thus ending the long loss of its value.

Thus, the inflation that would persist would be in the continuation of a growth of real GDP and an increase in (real) GDP per capita of about 5% per year, that is to say, by an increase in the wealth produced in Turkey.

Inflation is therefore not the absolute evil as all economists have been saying for decades.

Recep Tayyip Erdoğan is therefore right against them in opposing the increase in the base rate of the central bank, which would only create a damaging crisis for the Turks.

Much better, the continuation of a decrease in this prime rate would facilitate the decrease in inflation, which at 20% per year is still too high.

Inflation in the range of 5 to 10 per cent (as was the case in Turkey and France during the 30 Glorious Years) should be considered ideal because it encourages people to work, spend and invest the money they earn, which feeds the wealth creation of the nation and its people.

For this to happen, two fundamental conditions must be respected, and they are currently being respected…

The first one concerns the banks which must respect the prudential rules of indebtedness, in particular the one which imposes a leverage which must be lower than 10 as recommended in his time by Alan Greenspan, which is the case for the big Turkish banks, cf. my analyses.

As a reminder, this means that the assets of the banks must be financed by liabilities (and equity) that must not exceed 10 times the amount of their tangible equity.

The second condition for success is to keep sound money in Turkey, which is the first pillar of Reaganomics, according to Arthur Laffer, which means that the central bank must ensure that there is no undue money creation in Turkey, and this is precisely what has been happening for decades, and it is perfect!

This condition is met when the money supply M3 is less than 80% of annual current GDP and it is indeed met in Turkey,

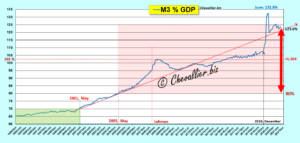

Document 3:

If these two conditions are respected, no matter the level of inflation (as long as there is no hyperinflation), the growth of real GDP can continue, and thus the wealth of the nation and its inhabitants!

Recep Tayyip Erdoğan, Turkey and… me (!), by opposing the doxa condemning any inflation exceeding 2% per year, we can therefore open up new perspectives renewing the problematic about inflation which is dangerously starting up again in developed countries because the fundamental conditions are not respected there, namely that a hypertrophy of the money supply has developed, and it is this that is lethal in the long run and not inflation stricto sensu.

Thus, for example, the money supply M3 in the euro zone is well above the critical limit of 80% of current annual GDP, which corresponds to a gigantic money bubble that leads to almost zero growth in the countries of this zone before a very likely banking tsunami because the banks have stratospheric leverage!

Document 4:

After having succeeded in conquering power, Recep Tayyip Erdoğan has managed to turn Turkey around by maintaining a very high real GDP growth rate there to the great satisfaction of the Turks.

He leads a policy independent of the great powers while often being at odds with their leaders who reproach him for this independence and who multiply criticisms and attacks of all kinds, including an attempted coup…

© JPChevallier.biz