Abstract

Turkey’s leaders give the impression that they have not understood the reasons for the success of the monetary policy they have pursued for the past twenty years!

Indeed, Turkey’s fundamentals are perfect: no undue money creation and banks that have good leverages.

The growth of real GDP has therefore been very strong as well as the gains in purchasing power of Turks with high inflation, which is normal and logical.

The current hyperinflation must be tackled as soon as possible by measures in favor of tax-free savings and investment to avoid capital flight.

Turkey’s leaders must clearly explain the correctness of their economic policy.

***

The war is first and foremost the war of ideas, according to Colonel E.M.G. Ludovic Monnerat (of the Swiss army). Then, it can pass to the diplomatic level and finally, it can become a real war, said to be of high intensity with deaths as it happened during millennia almost everywhere in the world.

The war of ideas includes economic warfare (in the broadest sense) which can take on many different aspects. It is for example the commercial war, the financial war but it is the monetarist war which is the most powerful and the least known…

Indeed, sound money is the first pillar of Reaganomics as Arthur Laffer wrote, which means that the monetary system of a nation is the basis of… everything else and it is therefore the main objective of the power that masters the modalities of this type of war.

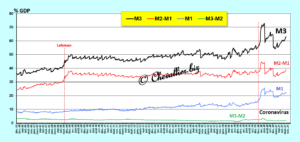

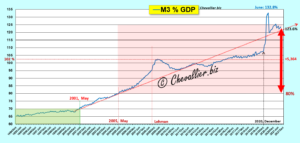

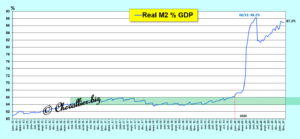

Money is sound when there has been no previous undue monetary creation in a nation, which is clearly and simply shown in the ratio M3 / GDP (in percentage): this ratio must not exceed 80%.

[M3 corresponds to all the means of payment circulating in a nation, GDP is here the current annual GDP].

This fundamental rule is respected in Turkey,

Document 1:

It is not respected in the major developed countries such as those in the euro zone, nor in Japan or China,

Document 2:

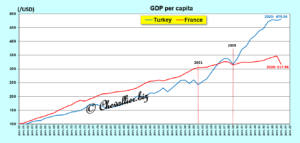

The monetary policy that has been conducted by the Central Bank of Turkey and by the government have benefited first of all the Turks whose standard of living has increased considerably over the last twenty years,

Document 3:

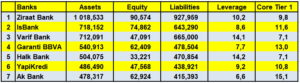

This success has been made possible thanks to Turkish banks that respect the prudential rules of indebtedness with a leverage of less than 10 for the most part,

Document 4:

The situation is a bit more complex currently in the United States because a money bubble has developed there (especially with this coronavirus story) but without undue money creation because it was financed by borrowing.

Document 5:

The most serious thing is that it is no longer even possible to analyze the evolution of the monetary aggregates of the United States because the leaders of the Fed decided in December 2020 to modify the definition of the monetary aggregates and to stop publishing them weekly as of February 2021.

They made this decision precisely so that no one outside the Fed’s confidential framework could analyze these data, which reliably predict the evolution of the U.S. economy and, in particular, the financial markets.

Currently, the Fed leaders are preparing an increase in the prime rate to stop the increase in inflation, which will create a recession that will lower American prices and burst the money bubble that has developed there.

This monetary policy is considered by the doxa as the only solution to stop the high inflation created mainly by the money bubble that has developed there.

It should not be applied in Turkey because the money there has remained sound, without undue money creation. Turkey is not America!

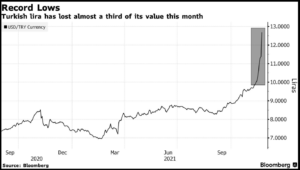

The Turkish lira is falling (compared to other currencies) mainly because many Turks are using the money they have earned and saved to buy currencies that currently allow them to earn 30-40% (year on year) without paying taxes!

Document 6:

The Turkish authorities should have intervened earlier to give Turks the possibility to open tax-free accounts to invest in Turkish securities or to invest directly (exempt from taxes on profits) in value-creating projects in Turkey.

In this way, the gains of Turks invested freely and spontaneously could have been greater than those obtained by buying foreign currency.

For such an economic policy to succeed, the Turkish leadership must clearly explain the reasons for the success of the economic policy it has pursued for the past 20 years and show that it is not always necessary to reproduce what is done and said abroad, especially in the United States.

All the media, under the influence of American financial (and political) circles, are intervening to criticize the action of the Turkish authorities, which amplifies this flight of capital (by Turks) that is causing the fall of the lira.

The Turkish leaders must react quickly to win this monetarist war that they have misunderstood.

Turkey, which is the heir of the Ottoman Empire, which is itself the heir of the Byzantine Empire, occupies a strategic place in the framework of relations between the East and the West. This is why it is attacked in a monetarist war.

The Americans have succeeded in defeating the European countries by inducing them to create a single currency, the increase in the mass of which has become uncontrollable, thus permanently impoverishing the nations and their inhabitants.

The same has happened previously with Japan and more recently with China.

The monetarist war is always accompanied by other forms of wars of ideas with the help of banks and companies, especially American and European ones, in an unceasing planetary war of influence…

© JPChevallier.biz